Top image: Mr Lawrence Wong Facebook

Whatever missteps the Government has made on the political front, I tend to forget them when it evinces its technocratic side. This is a Government with a “plan”, as was demonstrated by Mr Lawrence Wong’s maiden budget speech yesterday. I’m led to concur that this is why the People’s Action Party gets elected—it knows economics.

Mr Wong gave a masterly performance, eschewing nitty-ditty details and financial jargon to make the point that Budget 2022 was about strengthening the social compact we have with each other, even as Singapore makes its way in a world troubled by geo-political tensions and greater “contestation” for economic gain. He combined a grasp of numbers with the political ability to persuade audiences—at least, he did so for this audience of one. Also, he sounded far better on the ear than his predecessor Deputy Prime Minister Mr Heng Swee Keat.

ADVERTISEMENT

Perhaps, my assessment also had to do with how the speech included the crowd-pleasing announcement that the rise in the Goods & Services Tax will not happen this year. This, despite the chorus of commentators and experts expecting that it would jump from 7 per cent to 9 per cent in July as “there’s no good time to raise taxes”.

Also, despite businesses proclaiming that they preferred the simplicity of a one-step hike, he said this would be a two-step rise in 2023 and 2024—a one percentage point increase per year. Consumers who are counting the cost of their weekly marketing would cheer.

I reckon that delay had to happen simply because we hadn’t got out of the Covid-19 morass yet. To wit, Mr Wong announced a S$560 million package for households affected by the pandemic, which included a doubling of the GST voucher. For businesses, a S$500 million package that would help them tide over most of this year was allocated. This included a new plan for small companies to get at least S$1,000 a year or up to S$10,000 depending on the number of locals employed.

It would be too weird to kick in a GST rise while giving money to ease Covid-induced economic pain. It’s like robbing Peter to pay Paul.

Even as Mr Wong delayed the implementation of the GST hike, he went ahead to raise the marginal income tax rate for the ultra-rich, property tax for higher class homes (especially if owners don’t stay in them), and the Additional Registration Fee on luxury cars.

Combined, the revenue collected would be about S$600 million a year—this from just 1.2 per cent of income taxpayers, 7 per cent of property owners, and a much smaller number of car owners.

Still, it can’t compare with the GST as a revenue generator, but it would somewhat blunt the complaints about the lack of “wealth taxes” here to bridge the income divide.

The strains of our Social Compact

Merriam-Webster defines the social contract (or its synonym, compact) as ‘an actual or hypothetical agreement among the members of an organised society or between a community and its ruler that defines and limits the rights and duties of each’. It’s an age-old social philosophy that Mr Wong, in Budget 2022, leans on in laying Singapore’s approach to ensuring the symbiosis between nation and citizens is meaningfully preserved.

The pervading strain Mr Wong takes pain to address in this Budget is wealth. Or rather, the discrepancy of it—whether it be intentional or consequential. Increasingly, people are getting antsy about “elite” types who swan around in fancy cars and snap up good class bungalows, even more so if they are young people who strike it rich because they know how to use technology better by dabbling in crypto-currencies, for example.

It could be put down to envy, but it is a definite strain on our social compact, as Mr Wong puts it. The Internet start-up culture of entrepreneurs, crypto-currency dabblers and buyers and sellers of NFTs already look like a different species of humans to those plodding on in their day jobs, whether in hybrid form or not. In no time, technology and globalisation would put some people further ahead of the race.

This is a new-ish strain on top of the prospect of an ageing population, which would require more healthcare resources.

Another strain would be the tussle between those who think we should do more (and spend more) to mitigate climate change and those who wonder why they should pay for a plastic bag. Businesses will feel the pain first with raised carbon taxes announced in Budget 2022. From S$5 a tonne, they will have to pay S$25 per tonne in 2024 and 2025, and S$45 per tonne in 2026 and 2027, with a view to reaching S$50 to S$80 per tonne by 2030.

There is another strain that Mr Wong did not refer to but seems to have been somewhat addressed in the Budget—the Singapore-foreigner divide. This is accentuated by Singapore’s Top Strain—a persistent nagging belief that they are reaping benefits that should be due to Singaporeans and yet not abiding by Singapore norms.

Additionally. the salary floors for Employment and Special pass holders have gone up. This time, they are pegged to the salaries of local PMETs. For example, to employ a foreigner on an employment pass, companies would have to pay them at least S$5,000 a month, which would be in the salary bracket of the top one-third of local PMETs. This is a S$500 increase from the current level. Those in the financial industry have a higher salary qualification of $5,500.

Companies that want to hire foreigners for low-level jobs will also have to make sure their local employees are paid at least S$1,400 a month. This is known as the “local qualifying salary”, which appears to be functioning much like a minimum wage though I won’t count on the Government to admit as much.

Mr Wong made all the right noises—with the right pauses—in his Budget 2022 speech: “We want every Singaporean to know and feel that they have a stake in our society; that everyone’s contributions matter, and that they will not be left to fend for themselves when times are down. (Pause)

“We want to uphold that sense of obligation to each other and strengthen the assurance that, whatever the challenges we face, we will always have each other’s back. (Pause)”

Is Budget 2022 balanced?

To me, the most significant measure in this Budget to shore up the social compact is the State’s generosity towards low-income earners. I am not an economist, but I am conservative enough to question if, in working towards an inclusive society, would it come at the expense of work ethics and moving away from relying on the community as a social safety net?

ADVERTISEMENT

In a nutshell, is the Budget “balanced”?

The Government has always been accused of being tight-fisted when doling out welfare. Still, the fact is that it has been moving left of centre in recent years.

Consider the Workfare Income Supplement, which started in 2007. Then, it covered 280,000 workers aged 35 and above earning less than S$1,500 per month. The income ceiling has since been progressively raised over the years with higher payouts. Yesterday, that ceiling was raised to S$2,500, and the age limit lowered to 30, covering more than half a million workers. Payouts are also increased to up to S$4,200 a year.

More significant is the Government’s move to co-fund firms which have to pay increased salaries to their workers under the Progressive Wage Model (PWM) set to come into effect between 2022 and 2026. For workers earning up to S$2,500, for example, the co-funding rate will be 50 per cent in the first two years, 30 per cent in the next two, before tapering to 15 per cent in 2026.

The Government expects to spend an average of S$1.8 billion per year over the next five years or S$9 billion in total for the progressive wage credit scheme and the enhanced Workfare.

When the PWM was first introduced, much was made about tying the increases to productivity and weeding out companies that cannot compete except by using cheap labour. My hope is that the Progressive Wage Credit scheme would not become a crutch or, worse, be made a permanent fixture like the Workfare Income Supplement, which replaced the one-off Workfare Bonus in 2006.

Still, a question lingers: is subsiding the wages of the lower-income the best way to strengthen our social compact? To put it simply, is this more important than making sure that the economy can support good, well-paying jobs without government largesse?

A 4G leadership signature

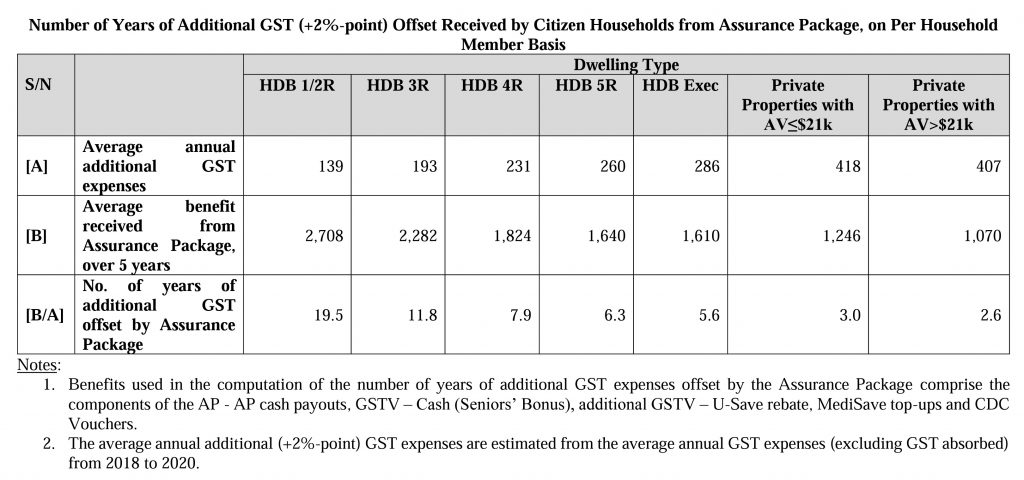

As for GST offsets, I was struck by this chart appended to the Budget statement.

I implore the minister to furnish details on the net GST revenue collected after offsetting the offsets when the debate on the Budget 2022 statement in Parliament starts on Feb 28.

Still, it seems churlish of me to gripe about money given out for free, especially for low wage workers. But giving out money merely builds up expectations of more. Are we as a society “resilient” only to the extent of the impact of State charity? Businesses, for instance, will be getting some help to cope with higher carbon taxes. Still, the State’s fiscal assistance will ultimately make its impact felt further downstream in the form of the household utility bill.

“We will provide support, such as additional U-Save rebates, to help cushion the impact during the transition. More details will be announced next year, ahead of the carbon tax increase in 2024,” said Mr Wong.

I was quite struck at the Budget’s generosity as I thought we would be in a belt-tightening period after withdrawing close to S$52 billion from the reserves. It transpired that only about $36 billion was used. Mr Wong said that an extra $6 billion was asked from the President for a ‘multi-layered public health defence. In-principle approval to withdraw from the reserves has also been given. This means that the total withdrawal amounted to $42.9 billion, less than the initial S$52 billion, as Mr Wong was eager to point out.

ADVERTISEMENT

He wasn’t too worried about balancing the Budget 2022 as quickly as possible either. He expects a deficit of S$5 billion for FY2021 and S$3 billion for 2022. Contrast this with past Budget statements exhorting the people to “save for a rainy day”, the need for financial prudence, and why the Budget must be balanced.

His speech could be a reflection of the 4G leadership’s commitment to making fairness and inclusivity a key consideration in policymaking. This will doubtless be cheered. Still, it’s worth keeping a close eye on the decisions made to ensure that moving further to the left will not be at the expense of the work ethic or the financial prudence we are famous for.