The Rules of the Game:

Welcome to Money Bootcamp, where we help our readers reach their personal goals by putting them through a rigorous financial transformation. We’ll be tracking their spending over the course of a week and keeping them accountable to every dollar spent.

To prevent cheating, participants will make purchases exclusively via DBS PayLah! Cash purchases that are unavoidable must be deducted from their wallet balance.

Our fourth intrepid saver/spender is Eileen, a 28-year-old digital marketer who’s new to financial planning. She’s been living pay cheque to pay cheque for the last 5 years and has been unsuccessful in saving her money. Most of her savings go towards travel (1 ‘big’ holiday and 3 ’smaller’ ones per year).

As she plans to get married and move to Australia by 2021, she’s decided to start planning her finances in order to save up enough.

My Life at a Glance

Age: 28

Industry: IT

Income: Around S$4,000.00 (after CPF deduction)

Goal: Save $40k by end 2021 (30 months), a comfortable amount to be able to move to Australia.

Fixed monthly (recurring) expenses:

Parents ($500)

Mobile ($100)

Investments ($300)

Insurance ($343)

iCloud 200GB storage ($3.98)

Internet ($49.90)

Total: $1,296.88/month, or $324.22/week.

Savings: Currently unrecorded.

What’s left (Cab, food, leisure, etc): Around $2,700

The Challenge:

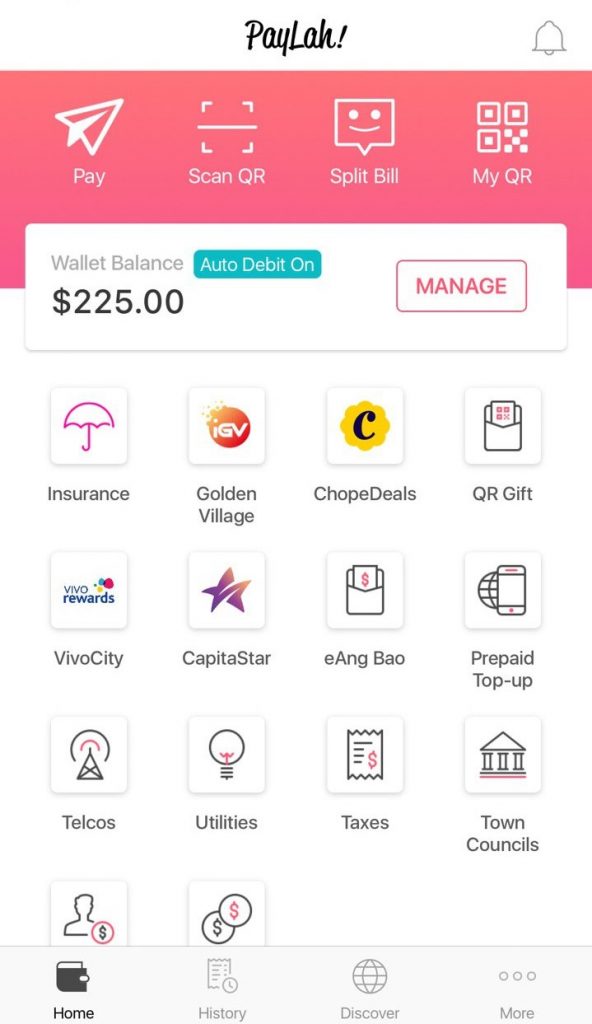

In order to reach $40k in 30 months, I’ll need to save on average $1,300 each month. That leaves $1,400 to use. I would still love to travel, so I’ll set aside $500 each month for a travel fund. That leaves $900 a month, or $225 per week for my day-to-day expenses.

I’ve never budgeted like this before, so let’s go.

Mondays are always slow days. As part of saving, I’ve decided to curb my habit of cabbing everywhere, and use public transport more conscientiously ($3.20). It’s a slog, but it’s all for the sweet, sweet new home Down Under.

I’d also like to be able to eat more at home. Besides summoning the willpower to drag myself to the kitchen, I need material to construct my nutritional cathedral on a budget.

So I go grocery shopping with my boyfriend. Buying yoghurt and fruits among other things bring us to $20, which is solid enough a foundation that will last many meals.

It’s a good start to the week! Doing the quick maths, $225/7 = $32 means I’m nicely under budget.

Day 1 total: $23.20

TUESDAY—Blessed By Freebies

The commute to and from work ($3.20) is another trudge through the warring currents of peak hour Singapore. But I dream of a more laid-back life away from our city state’s hustle, and I remind myself that good things don’t come easy.

I do give in to take a cab to lunch ($12) because convenience is too hard to give up … but it was a welcome lunch for a colleague, so it was paid for by the company! Never say no to a treat, because that’s how you ration your sanity.

And people say there’s no such thing as a free lunch.

Day 2 total: $15.20

WEDNESDAY—I See Where All My Money’s Gone

The day started out with everything on track. I worked from home so no transport expenses, and lunch was a humble kopi with fish soup and noodles ($5.58). I even used the Koufu app in order to get 10% off. 62 cents might not be a lot, but it’s the little things that count, right?

I ate out for dinner because we all deserve a mid-week reprieve. Foolishly, I cab to dinner, which comes up to $17.00 because peak hour traffic is a thing.

Dinner and drinks are a further $21.50, which seems modest for a night out. But being slightly tipsy and in no shape to survive my eternal commute back with the public, I decided to … take the easy way out.

Did I take a cab home? Yes.

What did it cost?

$24.60.

Day 3 total: $68.68 (YIKES)

THURSDAY—Not Great, Not Terrible

Waking up from the mild hangover of yesterday’s financial nightmare, I groan at the gaping hole in my wallet. Who knew that the moment you let loose, expenses would just keep piling sky-high?

I resolve to grin and bear it as I scrimp through the day.

Lunch ($5.00) and dinner ($6.80) is kept to the bare minimum possible without having to live like a broke student. The day is spent working from home, staring blearily at a laptop screen—oh no, I am living like a broke student.

In an effort to reassert my adult-ness, and because it feels like a very long week, I cab to my boyfriend’s home ($11).

Day 4 total: $22.80

FRIDAY—National Day Of Rest

9th of August falls on a TGIF without work! I thank the powers that be for the impeccable calendar planning. With Hari Raya on the horizon, it’s a four-day long weekend to rest and unwind.

I spend nothing but my time, lazing about and enjoying the luxury of simply switching off. Curled up at my boyfriend’s place, I refuse to meet anyone else.

To end the day, we cook a sinfully delicious maggi dinner. Sometimes, simple things are the best.

SATURDAY—So You Thought Wednesday Was Bad

After a quiet day of reprieve, it’s time to get out and enjoy the best things in life! Good food, great company, what’s not to love?

Buffet lunch with alcohol is the meanest treat I’ve had in a long time, coming in at a whopping $81.

Look. I have leeway to spend and splurge, given a few miserly days over the past week. You gotta just treat yourself every now and then!

Dinner is BBQ with friends ($30). Despite blowing more than half the week’s allocated budget in a matter of hours, I don’t feel terrible. I enjoy myself and what I’ve gained feels commensurate with what I’ve spent. As long as it’s not $40 plus on just cab fares, it’s good.

Day 6 total: $131

SUNDAY—That Final Song From High School Musical 1

So, my week hasn’t been going great, having already overshot my budget by about an extra day’s worth.

But I still have to live, don’t I? That’s where my amazing partner comes in. He knows about the challenge, and is sweet enough to pay for food.

We order a Burger King feast, and just have a great day together. After all, I don’t have to wait for 2021 to build a life with him. We’re already doing that day by day, supporting each other with the give and take that’s all too familiar between couples.

This is how reaching financial goals becomes bearable.

Day 7 total: $0

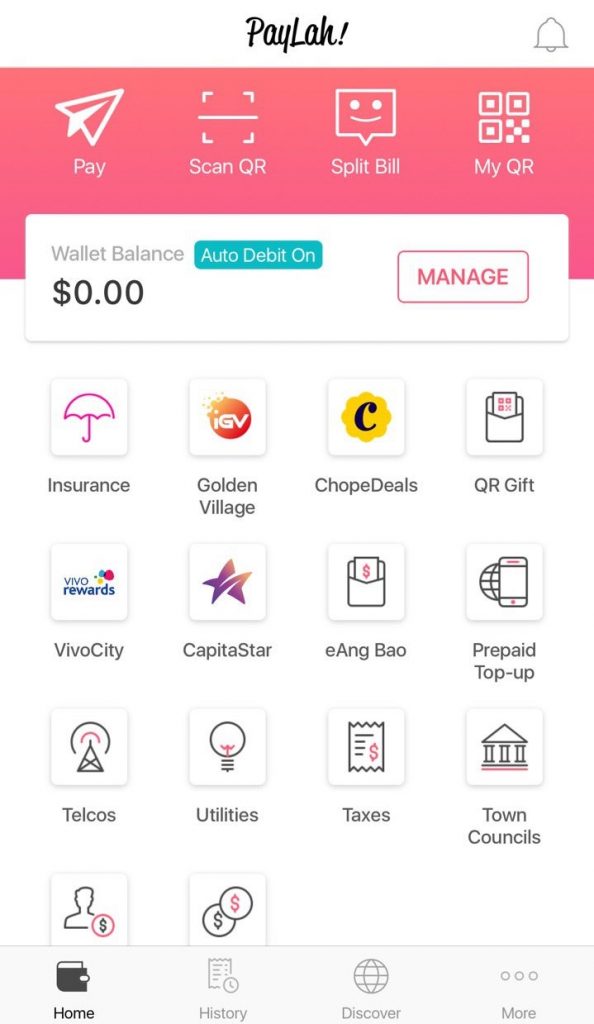

Money Bootcamp Results:

Jumping from effectively 0 savings to $1,300 each month is no joke, especially for someone who’s just starting their financial planning journey. I might have technically failed the week-long challenge, but at least it wasn’t a complete train wreck.

To reach my goal, any overspending will have to eat into my travel fund, which at $6,000 a year already isn’t much! But we have to sacrifice short term comfort for the future that we want.

Many Singaporean youth don’t really pay attention to their finances and having to do the numbers and planning can be really daunting! But we all have to start somewhere. From differentiating between spending that makes me fulfilled versus guilty, the necessity of sacrifice, and having strong support systems, I’ve learned valuable financial lessons during this week.

What’s left is to carry these lessons into the next week, and the one after, and after.

Today’s Money Bootcamp trainer is Yvonne Fang, NAV Wealth Planning Manager

Keep up those baby steps. Consider using saving facilities that automate your contributions to your savings account, and set up a giro system to install discipline in your saving.

Of course, don’t forget to explore accounts that offer higher interest rates based on your overall relationship with the bank, especially if you already credit your salary or have credit cards with one organisation. However, if you don’t already have lump sum in your account, you can look out for programmes offering cashback. Those few dollars from interest may add up to a good amount of savings!

If you need more information to get started, check out NAV where you can access a wide range of content to answer all your financial questions.

Make your money work for you with the DBS Multiplier Account, which earns you higher interest with no minimum salary credit or card spend. Finally, keep track of all your spending (or saving!) with the new DBS Digibank app.

Are you also dreaming of a new life in a land down under? Tell us about it at community@ricemedia.co.