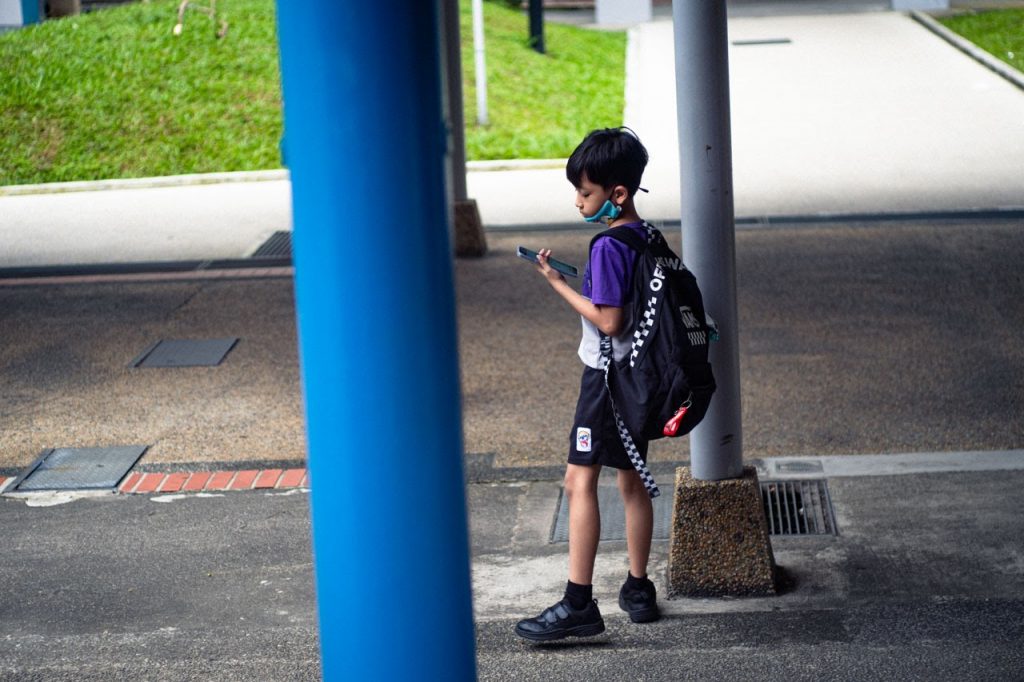

Top Image: Stephanie Lee / RICE File Photo

A kid on the bus I’m in is struggling to tell his helper how much his recess meal costs.

“My drink was $5, and bee hoon was 20 cents!” His helper reminds him he only brought $3 to school, so those prices wouldn’t have been possible.

As the child attempts to make sense of a dollar, I resist taking my largest brush and painting all children with the same stroke—kids these days don’t know how to count cash, let alone understand the value of money.

Surprisingly (or to my horror), my judgment is anecdotally validated.

Madam Mui*, my relative and a school canteen hawker in the West, tells me: “It’s not uncommon for primary one students to hand us their whole wallet and expect us to take out the money ourselves.”

What’s a Money?

Last I checked, we’re a little past April first. No jokes found here.

And yet, it feels like there should be a punchline waiting for us. Coming from a generation where tangible cash was king, it’s hard for me to fathom a 6-year-old child being unable to recognise a dollar from a 10-cent coin.

But that’s the apparent reality nowadays.

I recall a time when my wee self tried to buy a snack from a mamak shop. I, too, had asked the cashier to count the money out of my aunt’s coin purse. But she refused and said she couldn’t take responsibility, in case anyone accused her of stealing money.

It’s a valid concern. So it sounds incredulous that such behaviour 20 years later is the norm.

But what can canteen hawkers do? There’s a snaking line of hangry students, and time is of the essence during recess. Between feeding an army of kids and giving every child a crash course in finance, canteen hawkers can only suck it up, take the money they’re owed and hand the wallets back to the kids, their correct change safely tucked inside.

Ms Wei*, a hawker at a school in the Northeast, reports a similar phenomenon.

Her students often pay with notes instead of coins, which offers a straightforward solution for their inability to count coins. A single bill is definitely enough to cover their meal, and the kids trust that she’ll give them the correct amount of change.

However, the students don’t bother counting how much they receive, and therein lies another problem.

$2 and $5 bills are reasonable amounts for primary one students to carry, but Ms Wei often has to deal with kids turning up with far more money than they’re capable of comprehending.

Children who pay with $10 or $50 bills are surprisingly common. When they’re already struggling to count and keep track of literal dollars and cents, how would they notice if they’re missing a coin or a note from a thick wad of what are, essentially, just sheets of paper and polymer?

It’s an unfortunate recurring issue. Students stuff heaps of cash into their pockets, and juvenile carelessness means that money often goes missing. When students return to Ms Wei crying about their lost change, there’s not much she can do.

“It’s their word against ours, and we’re not going to insist a child was wrong.” To protect themselves from untoward accusations, the hawkers in her canteen have resorted to taking photos of them receiving and returning money to the students.

“We do this job because we love children, so the only thing we can do is keep a record that we’ve done our duty.”

Do primary one students eventually learn how to count money through trial by fire? Both hawkers can’t give me a definitive yes.

Care Less, Not Cash Less, with Cashless

Over at her school, Mdm Mui says most students pay for their food using the Smart Buddy system, which is essentially smartwatches-meet-e-wallets for students. With a quick tap-and-go, students collect their food without ever having to count pennies.

Sure, their watches display their remaining balance, but that does little to negate the cashless effect—a human tendency to spend more when no physical money is involved in the transaction.

The system does allow parents to set spending limits, thankfully. How the students spend within their limits, though, is another matter. If young adults are reporting higher expenditure due to the effortless convenience of cashless payments, what then of primary school children, who don’t even know the value of what they’re spending?

The dissonance between cash and cashless is so strong that when there was an internet banking outage, Mdm Mui’s students were left stranded without means to pay for their meals. Even though the school intervened and temporarily lent physical money to the students, many bewildered faces were fumbling to make sense of their newfound cash.

Is it simply because cashless payment is the default these days that kids struggle to comprehend money?

Megan*, a former kindergarten teacher, introduces me to Vygotsky’s Theory of Cognitive Development—a theory that believes that external factors, such as society and culture, play the biggest role in education. Though the theory can be applied to anyone at any age, it is commonly used in education by teachers to build concepts for their students.

The theory puts forth the role of a more knowledgeable other (MKO), a role model whom the learner will ‘mirror’ the actions—usually a teacher, their parent, or even an older peer. Whatever an MKO does, there must be a reason for it. Children therefore form their concept of what is happening by observing and copying an MKO’s actions.

When applied in an increasingly cashless environment, many children nowadays see their parents pay either with their card or phone and thus make the connection that the phone or card itself is necessary for the transaction—not the stored value inside. Cash, in itself, therefore, holds little relevance or meaning to a young child.

While perusing mathematical assessment books, I also realised the topic of money is only introduced towards the last term of the second year of kindergarten.

Megan explains that the concept of money can be taught only when a child understands numerals and the basic numeracy concept of addition and subtraction. While some books use simplified caricatures that aren’t instinctively recognisable as money, most use more true-to-life depictions of Singapore’s currency. Even then, the information is rudimentary, spanning just two to four pages.

As a result, children don’t get as many opportunities to see or handle cash both in and out of school. It’s not a wonder, then, that handling cash feels like trying to piece together a turbo engine without a manual.

Inculcating Calculations

It takes effort on a parent’s end to build a cash-based system for their children to learn from. After all, children are often, by nature, tactile learners. When letting her 5-year-old daughter buy food, Mrs Yap* prefers to hand her cash rather than a card.

“By giving [my daughter] cashless payment method items such as a (now-defunct) Kopitiam card, she doesn’t see how much she’s spending and doesn’t learn about the value of money,” she explains.

“It’s easy to tap, but it lacks the sense of quantity of how much you’re spending. With cash, it’s obvious from the quantity—i.e. the more coins you have, the more money there is.”

Mrs Yap and her husband would also engage their 5-year-old daughter in shopping roleplay, and gave her a practice wallet to instil money-minding habits and money confidence early.

Today, the child not only grasps the mechanics of using money but also comprehends its intrinsic value. The price tags on toys and clothes in shops make sense to her, and now that she understands how much things cost, she learns how to appreciate what her parents provide for her.

Ms Wei, however, bemoans that most parents can’t spare the time to teach their children and instead leave it up to the teachers.

Teachers only have those few hours in school to teach the concept of money alongside everything else in the curriculum. Without parents’ reinforcement, money remains an airy topic until it’s officially taught in the later stages of Primary 1. When children reach Primary 4, money no longer appears in the syllabus.

Primary Values

Singapore aims to introduce the Smart Buddy system to all schools by 2025, and the adoption rate of cashless payments across the country continues to rise. I can’t help but wonder if kids these days are doomed to lose the ability to count cash—and thus the ability to appreciate the value of money.

“Humanity doesn’t lose out on anything if children can’t count currency,” Megan quips.

She points to the evolution from barter trade to early currency, early currency to modern physical currency, and now physical currency to digital currency. People didn’t make sense of cash then, and there’ll come a time when they won’t need to anymore. As the environment changes, our relevant skills will adapt to whatever system of transaction becomes relevant then.

The only things that don’t change are basic arithmetic and the concept of trading. It sounds complex until Megan explains that trading is basically exchanging, which kids learn as soon as they experience causes and consequences.

Piaget’s Theory, another cognitive development theory that focuses on the autonomous construction of knowledge, all without guidance, explains it like this: As children explore their world, they will develop their concept of the world around them.

In this process, they intuitively assess value, discerning what merits exchange and what doesn’t. Whether trading a snack for a toy or homework for TV time, they will develop essential skills in resource management.

Gaming enthusiasts learn—through trial by fire—how much in-game currency is worth trading real-life currency for. The kids who used to crowd game shops to buy MapleStory cash cards understood what was and wasn’t worth it, and the folks cashing in on Genshin Impact today still utilise the same concept of trading.

Hell, even Chinese New Year gambling sessions make for great education sessions if you think about it.

As money becomes more relevant, kids will eventually pick up the things they need to know. Maybe they’ll make mistakes. Maybe they’ll get scammed. But that’s all part of the learning process.

Megan assures me: “Unless you decide to live as a monk, you’ll never lose the skill of making transactions and trading. The kids will be fine.”