It’s 10:00 AM on a Tuesday morning, but Wei Qing, 7, and Wei Xian, 4, are not in school. Wei Xian is on MC, and Wei Qing is having the runs. We are sitting in the doorway of their bedroom while they doodle on some scrap paper; their stick-figure drawing of me has a curly ponytail and butterfly wings.

You wouldn’t know this, because Wei Xian looks and behaves like any other 4-year-old—chirpy, cheeky, and all too eager to show off her favourite sticker book. But when she was just 21 days old, she contracted a serious form of meningitis, an inflammation of the membranes which protect the brain and spinal cord.

She passed her man yue, the traditional celebration of a Chinese baby’s first month of life, in the hospital, eventually moving from the neonatal ICU at KKH to a regular paediatric ward.

“We read up online and it said there was a chance that the illness might stunt her growth. We were scared that she wouldn’t make it, or if she did, that she wouldn’t grow up like other children,” her mother, Mdm. Chan tells me.

Wei Xian made it to her first birthday, and then her second, but the effects of her illness still linger. At 4, she still struggles with food; when she is unwell, she throws up most of what she eats. To ensure she gets the nutrients she needs, her mother gives her a special kind of infant formula, one tin of which costs $90.

Her overall health remains fragile. This year alone, she has been admitted to hospital 5 times (the most recent stay ending just a few days before my visit); last year, it was 7. Her mother tries to explain what the cause is—some kind of growth, or obstruction, in her gut that isn’t life-threatening, but nonetheless serious enough for their GP to refer them to the hospital whenever it flares up.

“At least we have insurance now,” says Mdm. Chan. The combination of the basic policy and the rider Wei Xian is under provides 100% coverage. Without it, this most recent stay would have set them back a few thousand dollars.

By contrast, the year in between Wei Xian’s first and second birthday passed in a haze of prayers, tears, and the unremitting anxiety that comes with having an uninsured baby in poor health. Her medical history meant she had to spend a year in the clear before any insurer would be willing to cover her, or at least with premiums the family could afford.

“What insurer would pay?” asked Mdm. Chan.

There was nothing for it but to hope for the best, because continuing uninsured was not an option. They had already wiped out both their savings and CPF funds, borrowed $3,800 from Mdm. Chan’s brother, received financial aid, and still struggled to pay off Wei Xian’s medical bills. There was just no money left.

The bedroom in question is the only one in the house, a two-room rental flat in Whampoa. More than half of it is taken up by a mattress, on which the girls, their father, Mr. Tan, and Mdm. Chan all sleep huddled together at night. The rest of the space is filled by a wardrobe and stacks of toys, school supplies, books, and other paraphernalia, all piled haphazardly against the wall.

Mr Tan works at a hawker stall in Yishun, taking home $2,500 after CPF. This is the family’s sole source of income (Mdm. Chan stopped working after Wei Xian was born). He recently got a new job, and with it came a pay raise; he used to bring home $1,800 in his old role.

The bump in income has helped tremendously, as has the consistency and predictability with which it is paid out. His previous job paid out in dribs and drabs—$50, $100, $80—meaning that the family was not only living hand-to-mouth, but had no idea when they would next have cash in hand.

The extra $700 means, for the first time in years, that the Tans see some money left in the bank at the end of the month. It also means that overnight, their rent increased more than fivefold, going from $44 to $240 when Mr. Tan’s first pay raise took them over the income ceiling for their flat type. (It is now $300, given the salary hike at his new job.)

Despite this, Mdm Chan insists, they are managing. It’s still a stretch, but things are better than before. They no longer see bills piling up on the dining table, angry red text reminding them that they owe $900 to HDB, $400 to Singapore Power, $300 to the town council.

For the last two years, the family has been enrolled in the Family Development Programme (FDP), a poverty alleviation programme run by Methodist Welfare Services (MWS). It aims to help beneficiaries restructure their finances and escape the poverty cycle, first by helping them find ways to pay down their debts, and then slowly build up their savings.

For every dollar of debt that a beneficiary family manages to pay off, or every dollar they manage to save, MWS will match it twice (up to a cap of $100). As such, they clear debts or accumulate savings three times as fast.

The Tans are now in the savings-matching part of the scheme. Every month, whatever they manage to squirrel away from Mr. Tan’s salary (they try to set aside $100 a month for their daughters) will be matched and doubled by MWS, giving them a total of $300 in savings.

The effects of this financial breathing room cannot be understated. It means that an emergency, like a broken fridge or a chipped tooth, need not destabilise their finances. It means that one spontaneous indulgence—an ice cream, a taxi trip—won’t send them into a tailspin of guilt, shame and worry gnawing at their stomachs. It means being able to sign the kids up for programmes, knowing they will be able to pay the monthly fees.

It means thinking of time differently; seeing that the future is longer than the due date of the latest bill. That there are goals to achieve and plans to make, because now they can be made. That there is a long-term view.

“The outcome of the FDP is not to [help beneficiaries] reduce debt, or even have savings,” Cindy tells me. “Those are by-products. The outcome is actually behavioural—to help create a cognitive shift, where they go from a present bias to taking the long-term view.”

The important thing, she explains, is to help beneficiaries recognise that they have the means and agency to make choices, rather than being constrained to addressing needs or seeking short-term gratification.

To this end, the whole point of agency is freedom; believing this—in people’s full, lived humanity—also means recognising that people have the right to make their own choices. As such, the money the beneficiaries receive (in either the debt-clearance or savings-matching arm of the scheme) comes with no strings attached. MWS’ volunteers might suggest it be saved or used to pay off a debt, but they will not dictate how the beneficiaries should apply it.

“The FDP is not meant to be punitive, where you’ll be penalised if you don’t meet a certain savings target or pay your debt,” Cindy explains. “This is not wrong, but it’s a very linear method when you consider all the factors which perpetuate poverty.”

She tells me that while prospective donors are usually keen to support the savings-matching arm of the FDP, it’s often harder for her to explain why the income buffer is necessary.

“People do give very, very generously. Everyone wants to help, and this is great. But the issue here is how we understand what maintains poverty.”

“If we see solving poverty primarily as an individual responsibility—like, you make the effort and I’ll match it—it’s very effort-driven, as opposed to creating opportunities for the poor to enjoy access and help them make that effort in the first place,” she continues.

“If I think of it this way, then I might be very keen to reward saving, but I might struggle to give towards the buffer. And the buffer is the first step towards accounting for some of the structural issues which maintain poverty.

So now we try to help people see that poverty is structural as well, though it’s not always easy to tell if it’s structural or individual for every family. The truth is always somewhere in between.”

This TV, according to Jimmy, their MWS volunteer caseworker, caused them all—him included—a fair amount of grief.

In the Tan’s second year on the FDP, while they were still trying to clear other debts they owed, they bought the TV on an instalment plan at Courts. “Unfortunately, they didn’t keep up with the payments, and the bill ballooned from $1,000 or $2,000 to over $4,000,” he explains.

“So we sat down with them and said, you might be keen on the savings-matching, but you need to pay down the debt first. We’ll see if we can help a bit, but go talk to Courts.” They managed to come to an agreement, and in a year, the Tans managed to pay down over $3,000 of the arrears.

According to Jimmy, this was a tremendous improvement from their early days on the programme.

“Quite honestly, they were not a family we liked to work with. They wouldn’t cooperate in providing documents, sometimes I’d ask for a bill and it would be drawn on or torn up into little pieces. And they weren’t very good about paying down their bills. So after 6 months, we were actually thinking of taking them off.”

Mdm. Chan concurs. “Back then, when the bills came, I would ignore them,” she says, smiling sheepishly, “I would put them in a corner and not look at them because I didn’t want to deal with them, I felt so helpless. I would just wait for my husband to come back, but then we had no money anyway.”

“But we got better at handling this in our 2nd year [on the FDP]. Jimmy taught us to put all the bills in a box.”

With regular counselling and coaching, as well as the mental and financial breathing room created by the income buffer, the Tans became more proactive in managing their money.

“They’re very consistent now,” says Jimmy. “They’ll give me notice if they think they might be late paying one month. And then they will pay and send me a photo of the AXS receipt.”

As their paper’s introduction puts it, “… the demands of daily life under scarcity create ‘bandwidth taxes’ that sap mental resources, impairing cognitive ability, and causing counterproductive behaviour which perpetuates poverty”.

According to the academics, these effects are due not just to the economic costs of owing money per se, but the cognitive load—‘mental accounting’—which is incurred by living with debt.

Let’s imagine you’re $1,000 in debt, owed to a number of different creditors—your landlord, the utility company, the town council, the telco, the friend you borrowed a bit from to help tide you over. A bit of money has just come in from your part-time job, giving you $100 in cash.

What do you do with this?

Should you pay off the rental arrears first? The power bill? Or the telco, so your line isn’t cut off in case you need to call the other creditors to ask for more time (or your kids need to call you)?

Or: should you buy food for the next week? That’s 7 whole days of not needing to worry about dinner. Should you top up your child’s ez-link card? Buy them new school shoes to replace their battered, too-small pair? Or do you get them that toy they’ve been asking for, as compensation for all the other little desires which go unaddressed throughout the year?

Do you put down a deposit for a TV, knowing that you cannot afford to take the kids to the mall (Fast food! Toy stores! Infinite temptation!), and cartoons will keep them happy and entertained throughout the interminable weekends spent at home?

Recall Economics 101: scarcity requires choice, which requires deciding which trade-offs you can afford to live with. Decision-making, even at the most trivial level (should I have cai png or treat myself to a bento for lunch today?), requires time, effort, and attention. Multiply this by all the choices you make in an average day, and the result is some idea of the psychological burden of life under chronic debt.

My social worker has found me a job interview. Should I buy a new shirt for it? Can I afford to? Do I take the bus there (air-con will keep me looking presentable), or should I suck it up and walk? Who will look after my kids while I’m there? Actually, if I take this job, who will look after the kids? The money I bring back would never cover the cost of childcare.

As Cindy put it, “Poverty is chronic stress. Chronic debt is chronic stress.”

In March this year, Sharul, Singapore’s first full-time female stand-up comedian, debuted her tragicomic one-woman show, Crazy Poor Sita. It follows the life of Sita, a single mother trying to eke out a living and raise her children while caught in the poverty trap.

As part of her research in crafting Sita’s life story, Sharul spoke with beneficiaries and volunteers from the NGO Daughters of Tomorrow (DOT), as well as reading through dozens of transcripts and other data collected by their case workers. Some of these left her in tears.

Sharul tells me about how some of the interviewees were told “if you’re poor, why do you dress up so well?” or that they just “didn’t look poor”. In truth, they had scavenged their clothes—cast-offs from upmarket brands—from the recycling bins of void decks.

We stare at each other over our $6 coffees.

How is it that this happens in this country? But as her words sink in, I consider the unsaid expectation beneath the comments: that being poor must equate to looking poor, or at least, ‘poor enough’.

Any woman will tell you that trying to look nice is sometimes your last line of defence against a bad day. And if one is not allowed to find dignity in the smallest of things, what else is there to fall back on? How else is one meant to be a person?

“Stories like this really affect you,” Sharul continues. “But what I realised through putting this show together is that lots of people just don’t know poverty like this exists in Singapore. At every show, I (as Sita) ask the audience why they think poverty still exists, and at least two people will tell me it’s because people are lazy.”

“But after the show, you can hear the silence in the room. It’s like, oh, fuck.”

But we will never see poverty in all its shades unless we keep trying to take the whole thing apart.

This piece should—if I’ve done my job—give you some idea of how densely and intimately connected the issues are, and how the smallest things add up to a cumulative, terrifying, web of factors that work to trap people in poverty. Bad luck, bad circumstances, and bad choices all contributed to the Tan’s current situation, as have the cracks in the system which they fell through.

Still, as Mdm. Chan maintained throughout our interview, things are better than they used to be. They are coping—for now.

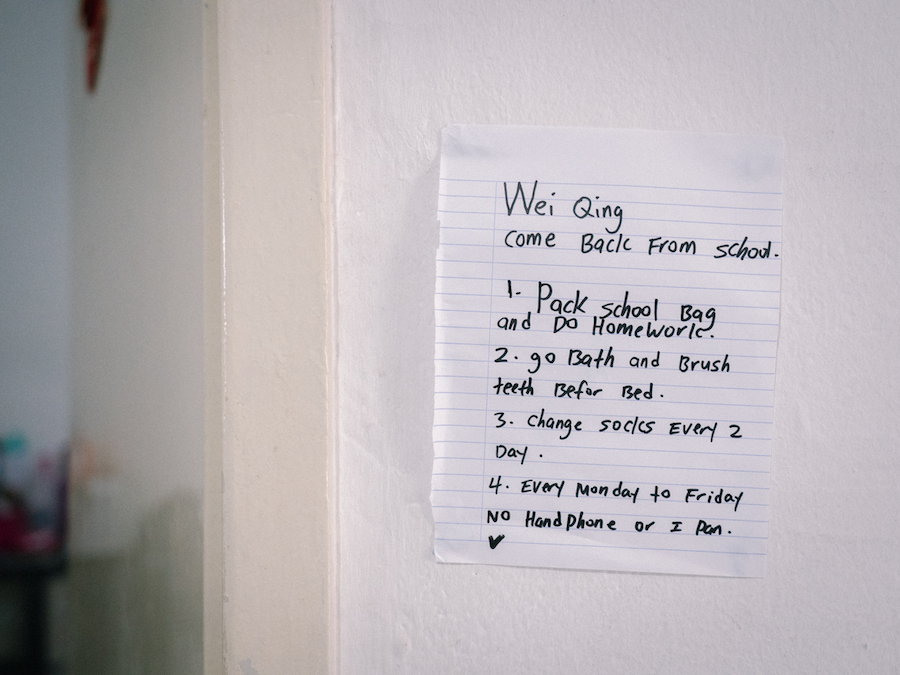

At the moment, only Wei Qing is in school. Wei Xian will join her in a few years, which means two girls’ pocket money, books, supplies, and outings with friends. Children eat more as they grow up. They will outgrow their clothes, start to need sanitary pads, request make-up and mobile phones and all the other things vital to a young girl’s sense of belonging. The nesting doll will acquire more layers. (All this time, we haven’t said a word about how the Tans will cope when they retire.)

For now, though, there are sticker books and packet green tea and bear hugs before Mr. Tan goes to work. It’s not a lot; it’s barely enough. But it, like their story, is all theirs.

In conjunction with the International Day for the Eradication of Poverty on 17th October, we have teamed up with local NGOs to raise awareness of poverty and inequality in Singapore. Check out the Stand Together Festival for more information.

Have something to say about this story? Write to us at community@ricemedia.co .