Welcome to Money Bootcamp, where we help our readers reach their personal goals by putting them through a rigorous financial transformation. We’ll be tracking their spending over the course of a week and keeping them accountable to every dollar spent.

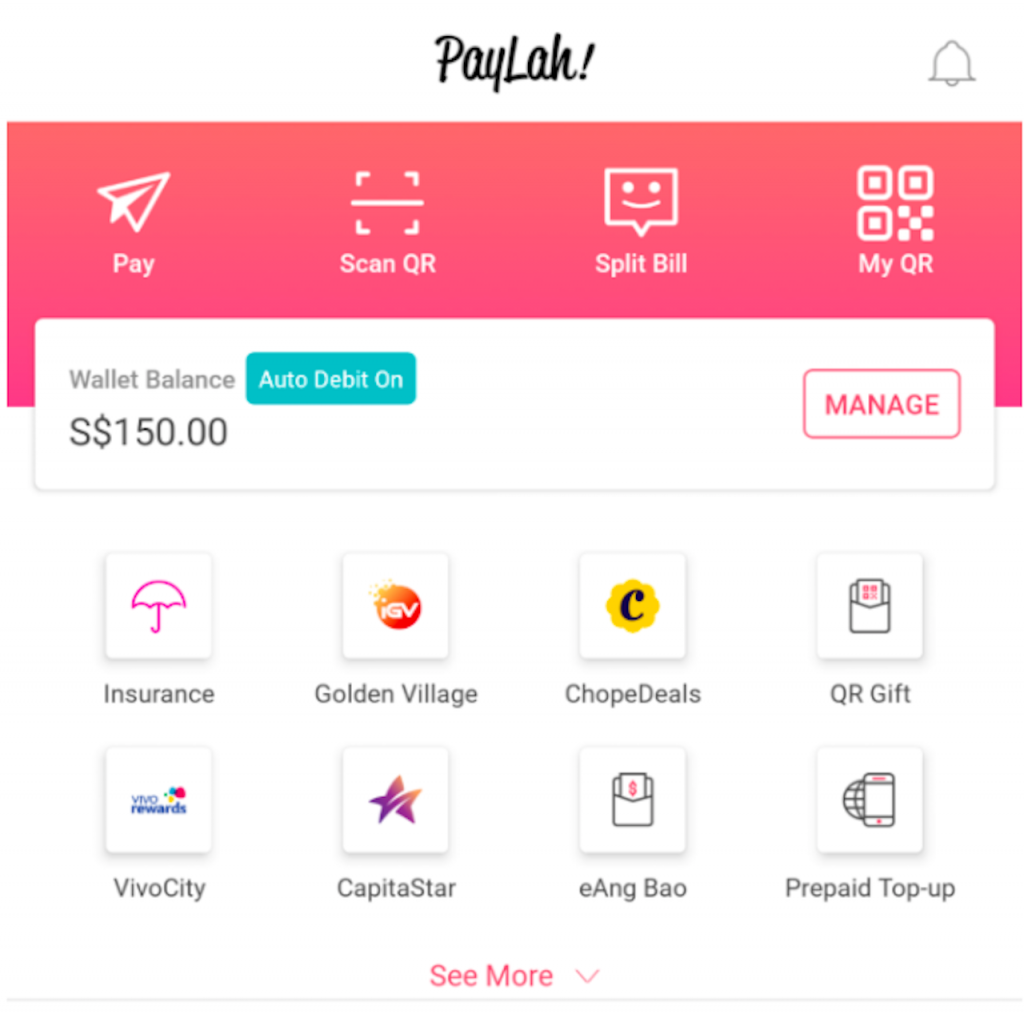

To prevent cheating, participants will make purchases exclusively via DBS PayLah! Cash purchases that are unavoidable must be deducted from their wallet balance.

Our second intrepid spender/saver is Grace Yeoh, our 29-year-old current affairs editor at RICE, who tells us about her quest to save $100k before she turns 30 as her “Get Out Fund”.

“Think of a ‘Get Out Fund’ as an emergency stash or back-up plan that you activate when, for example, you break up with a long-term partner you live with or leave a job that’s been your single source of income.

I’ve always been relatively independent, but this fund means I’ll never need to stay in a situation for shelter, salary, or solace. I can up and leave the minute I want to and still be financially okay.

The common ‘financial advice’ to have $100k in savings by 30, coupled with burnout several times this year, made me determined to lock this fund in by the time I hit a new decade. Too many times, I’d type a resignation letter and save it in my email drafts, as some illusion of power. But the truth is I never truly felt I could leave without a backup plan—simply because I could not afford to be unemployed indefinitely while figuring out my next step.

Reaching my ‘Get Out Fund’ in time gets my mental health back on track, because I know I am not just saving money; I am (quantifiably) saving myself.”

Age: 29

Industry: Publishing

Income: S$3,038.50 (after CPF deduction)

Goal: Save $100k by the time I hit 30 next year. This is the comfortable amount I’d like for my “Get Out Fund”.

Fixed monthly (recurring) expenses:

Investments ($500)

Netflix ($7)

Parents ($660)

Public Transport ($100)

Total: $1,267/month, or $316/week.

Savings: Currently at least $1,100/month.

What’s left (Cab, food, leisure, etc): $671

The Challenge:

I’ll get to my “Get Out Fund” at the current pace of savings, but I honestly don’t know when I’ll burn out again, and I cannot predict how severe it’ll be when I do. So just in case, I will limit my expenditure to $600 per month for the remaining 10 months before I turn 30. This adds up to $150 per week.

The race is on.

I get up on the wrong side of the bed, so I down a cup of black coffee before leaving home and make another exact cup the minute I reach the office to get myself ‘in the zone’.

It helps! Hooray! … for all of about two hours.

Before lunch, I type “I’m feeling like a Park Bench Deli sandwich,” to my editor over Slack.

“Oh, is it that kind of day?” he replies.

“Yes!” I laugh on the outside while dying on the inside. It is absolutely a $17.10 sandwich kind of day.

I don’t take rain checks often, but I cancel dinner with a friend because I’m not in the mood for conversation or company. Instead, I head to Workspace Espresso bar at Novena to get some work done and heal my heart over a warm grain bowl ($12) and long black ($2.50). Surprise, surprise: I am unproductive and I still feel meh.

Reminder: Sometimes I gotta do what I gotta do to do anything else.

Day 1 total: $31.60 (Yikes!!!)

TUESDAY — New Day, New Slate

It’s a black coffee morning again, and I set aside time to work on my speeches for a few panels I’ve been invited to speak on this month. I don’t know what I was thinking when I took on these extra lobangs, because I am DYING.

Still, even though it’s counterintuitive, my ‘side hustle’ acts as a reprieve from my day job, and the distraction alleviates my mood.

I continue to harvest my introvert energy through a solitary lunch at Maxwell. For $4.20, I get a plate of Hainanese curry rice, a slice of pineapple, and some much-needed time alone.

This gives me enough energy to have an hour-long dinner with another friend that night ($10.90).

Day 2 total: $15.10

WEDNESDAY — Getting Back on Track … ish

At 7-ish, I meet a colleague for our regular morning kopi c kosong peng ($1.50) so we can get into work early. Lunch is at Cheeky’s—a new restaurant along Neil Road—with my friends from poly, who’ve been raving about it. When will I get to save money? Perhaps in the next century.

At least the pork burger and kaya pancakes ($20 in total) are satisfying.

After dinner ($8.10), I accompany a friend to get some pastries and feel tempted to get some myself. The more we buy, the greater the discount, apparently.

But then I remember the one savings rule I adhere to: If you buy something you don’t want or need, you’re not saving. You’re spending.

Day 3 total: $29.60 (F M L)

THURSDAY — The Cost of Self-Indulgence

I wake up late but feel amazing after clocking nine hours of sleep. I’m sorely tempted to book a cab because it feels like I deserve it, but in the end, I decide to take the MRT. Reaching work last is stressful for this perfectionist.

I take the intern I supervise out to lunch and surprise another colleague with a slice of the most decadent chocolate cake. Total cost: $30—but their happiness makes this worth every cent.

Before I know it, it’s past midnight and I have to book a cab home ($22). But learning from this morning I persuade my inner critic that it’s perfectly okay.

Day 4 total: $52 (… …….)

FRIDAY — Tiny Things Add Up

I attend a complimentary barre class with my colleagues, one of whom is the instructor for today. During class, she shouts “You work for RICE. You are a masochist. You can do this!!!!” cracking us all up. My people are really why burnout hasn’t gotten the best of me.

I fork out $5 for ice-cream and $6 for iced coffee, then book a Grab to a friend’s office to return her stuff she urgently needed. My two-way journey cost $14, but she pays for half to thank me for my trouble.

Day 5 total: $18

SATURDAY — Back to Square One

Mildly upset that I spiralled out of self-control this week, I force myself to do a mini purge/reset over the weekend.

Before leaving home, I make a peanut butter and jelly sandwich for breakfast. That—and my determination—manages to keep the hunger at bay.

Till lunch.

Which is leftover cake in the office … where I’m working … on a Saturday.

To be fair, I only do this when I’ve had a particularly rough or unproductive week like this one, or when I’ve taken on more than I can chew.

Finally, dinner is home-cooked food with the fam. Aside from the fact that I spent Saturday working, today’s not too shabby. Spent zero dollars and locked in precious family time. Score.

Day 6 total: $0

SUNDAY — The End. Thank God.

I wake up craving the white carrot cake near my place—one of my go-to comfort foods. After a long and tiring week, I deserve this. Besides, what’s $4.20 in the grand scheme of things?

I feel back in control and am no longer in the funk I start the week with. I also rethink my relationship with money and why I feel weirdly guilty when I spend on myself, but perfectly fine spending on others.

Day 7 total: $4.20

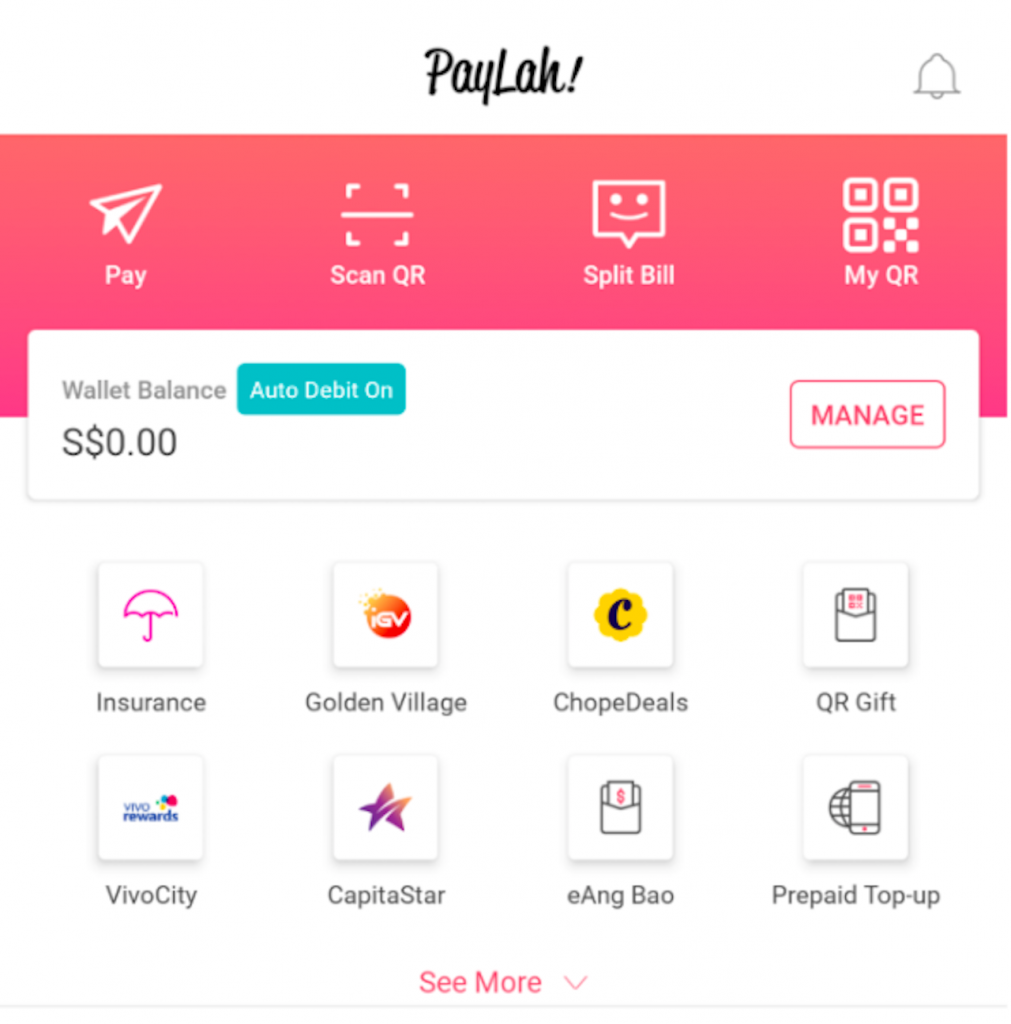

Money Bootcamp Results:

WEW. Just $0.50 over the limit!!!

This week showed me that I should cut myself some slack when I spend on things to feel better and be kinder to myself.

Besides, burnout isn’t solved by a one-time solution. While money can’t solve the root cause, it does help relieve the symptoms, while I sort out longer-term solutions.

Still, for a ‘rough’ week, the final amount spent isn’t too demoralising. I almost wish I’d allowed myself to indulge a bit more, like when I opted for the MRT instead of hailing a cab… The opportunity cost was my energy, and not worth it.

I reckon if I’m disciplined during less mentally and emotionally draining periods, I can live large during weeks where I need to escape with indulgences. Ironically, why I’d spend more is precisely why my “Get Out Fund” exists at all.

Which, I must say, truly reinforces its necessity.

“Good going! But while you work hard towards saving for your ‘Get Out Fund’, don’t forget that you can also make your money work for you! Based on your current expenditure, your ‘Get Out Fund’ of $100K can last you for more than 50 months (that’s more than 4 years without any change in your lifestyle!) – you can definitely afford to invest a sizable portion of your ‘Get Out Fund’ without compromising on the flexibility to up and leave whenever you choose to.

A proposed guideline is ensuring you’ve invested 50% of your net worth (net worth refers to the amount by which your assets exceed your liabilities), which is a safe target, so your funds are not eaten away by inflation either.

Also, while it’s important to have goals that you want to work towards, remember to also set aside at least 3 to 6 months’ worth of emergency funds on top of any of those goals. In your case, that will add up to approximately at least $5,814 to $11,628 in emergency savings. [Computed by (3 to 6) * ($1,267 + $671)]. Emergency savings are important to help you tide over unexpected life events while not affecting your other life goals.”

Make your money work for you with the DBS Multiplier Account, which earns you higher interest with no minimum salary credit or card spend. Finally, keep track of all your spending (or saving!) with the new DBS Digibank app.

Has money solved your burnout before? Tell us at community@ricemedia.co. We can commiserate.