Top image: Zachary Tang/Rice File Photo

Twelve. That was how old I was when the Goods and Services Tax, or GST, was last raised in July 2007. I’m now 27.

Back then, my friends and I were still in school, barely aware of what was going on, nor felt the pinch from paying more taxes, as we weren’t earning our keep yet.

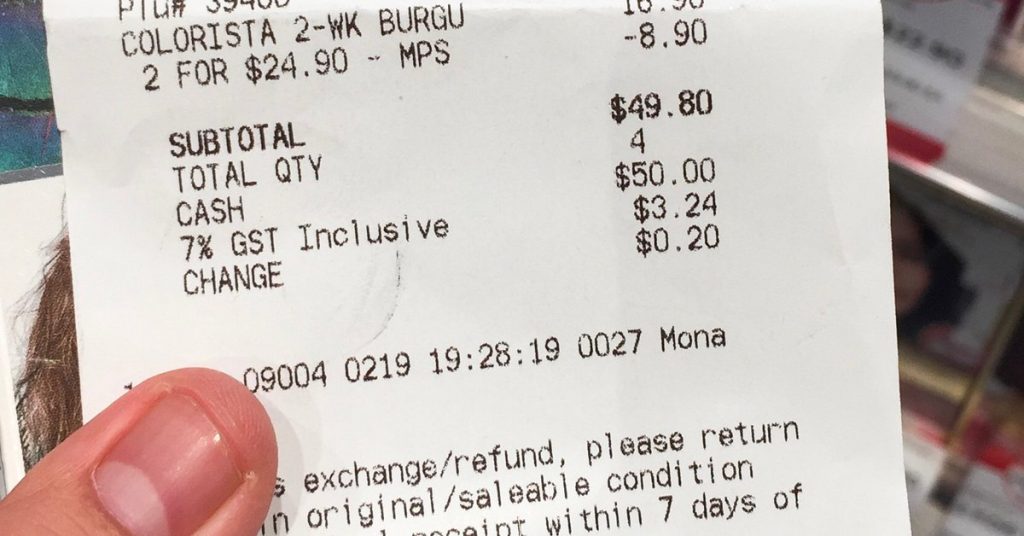

Still, for 15 years, we acclimated to a seven per cent GST in our daily lives, multiplying numerical figures by 1.07 on the phone calculator when we split the bill with our friends after a meal together.

That is, until last Friday, Feb 18, 2022.

Armed with a thick folder and an appetite satiated with porridge, Lawrence Wong stood at the pulpit for more than two hours and delivered his first Budget statement as Finance Minister.

At 5.12 PM after trading closed for the day at the Singapore Exchange, he announced that Singapore would raise the current GST from seven to nine per cent in two stages—by one percentage point each in 2023 and 2024.

It’s not surprising. We have been prepared for this day since 2018 when Minister Heng Swee Keat first revealed the plan at the year’s budget. Recently in his New Year’s message, Prime Minister Lee Hsien Loong further hinted at a GST hike that will happen sooner than later when he said that we should “start moving” on this.

What’s at stake for 2022: Winning hearts and minds

When the government raised GST 15 years ago, social media has yet to become a buzzword. We relied only on the mainstream media for news. Facebook was still in its infancy, with users mainly using the platform casually instead of discussing current affairs—the environment for discourse was more controlled.

But what about now? With social media, Singaporeans have been amplifying their thoughts of the announcement online, beyond the dinner tables.

And unlike in the past, opposition parties are now not beholden to the mainstream press to air their views when they can make fodder out of GST—or any pertinent issues to wit—through social media. Some, such as Progress Singapore Party and Singapore Democratic Party, have made their stance known via a live-streamed forum.

The government will find it harder than before to control the narrative over GST and persuade Singaporeans that the hike is needed. So what can they do to win hearts and minds through their communications?

That, when we look back at the archives, the political timing of a GST hike has always been well-planned, considered, and carried out in the middle of a parliamentary term. It’s a deliberate move so that the thorny issue of taxes has never been a hot potato issue during an election campaign.

The current hike is the first since 1994 where a GST hike was mooted before a general election and implemented after. Even so, other issues such as jobs and livelihoods in the light of the pandemic took centre stage during the campaign instead.

What’s at stake for 2022: Net Investment Returns Contribution

Imagine this: As a young child, your family has a piggy bank of savings, which is only tapped on during emergencies. However, the family’s expenditure is increasing as your grandparents age and your father is about to retire, with only one grandchild working to support everybody.

So, your father takes some money from the piggy bank, bought some shares, and earns extra cash from it. He takes out half and tells everyone that the money could be spent on groceries or paying off utility bills. The other half is ploughed back into investments for more returns.

That’s a simple explanation of how the Net Investment Returns Contribution, or NIRC, works. Under this arrangement, the government can spend up to 50 per cent of the expected long-term actual returns from net assets invested by investment entities GIC Private Limited (formerly known as Government of Singapore Investment Corporation) and Monetary Authority of Singapore.

Parliament amended the Constitution in 2008 to allow for this and later expanded it further in 2015 to include Singapore’s other investment instrument, Temasek Holdings.

To wit, the national purse now has more funds after the government included proceeds from investing our reserves. In the upcoming financial year (FY), for instance, the government is estimated to have S$21.6 billion from the NIRC.

NIRC: Sufficient, yet still not enough

This NIRC component single-handedly contributes the most to our revenue. For example, in FY2019, the NIRC contributed 18.7 per cent of the year’s S$91.3 billion overall revenue.

Logically speaking, if there’s more revenue from the NIRC, there’s less of a need to raise GST. In 2007, we could still justify the increase of GST because Singapore didn’t have this extra source of revenue.

Now, the NIRC has contributed considerably to our budget. Yet, the impending GST hike suggests that the extra revenue generated from the NIRC is not enough to cover our projected spending. And if we were to take Minister Wong’s word for it, this seems to be the case.

He said during his Friday’s budget statement: “If our current healthcare spending, excluding Covid-19-related expenditure, continues to increase at a similar rate over the coming decade, we will spend about S$27 billion or around 3.5 per cent of GDP (Gross Domestic Product) by 2030.”

In fact, he added that the increase in revenue from GST cannot cover this spending entirely—let alone just relying on existing NIRC funds and other income streams. And if the government wants to carry out various programmes to help Singaporeans, be it co-funding the salaries of lower-wage workers or giving more healthcare subsidies, the money has to come from somewhere.

This argument sounds obvious, but we often overlook it, which is why Minister Wong gave a salient reminder last Friday: “No one likes to talk about taxes but there are no painless solutions. Ultimately, every need must be paid by someone. Every dollar not paid by one person will have to be made up by someone else, either today or in the future.”

In a way, the substantial revenue from NIRC helped us stave off a GST increase for the past 15 years, but today, even with that extra cash, our spending has reached a point where we need more tax money to sustain it.

Maybe if we look through the archives, we can better understand why the government pushed for an eventual nine per cent GST.

The national expenditure at various milestones, for example, is a good indicator—we are now spending more than what we used to in 1994 (when we first had the tax), 2003 and 2004 (the first two hikes), and 2007 (the last hike).

From the archives: looking at past GST milestones

1994: Introduction of GST

As early as February 1986, the government was already mulling the idea of a GST, eight years before Singaporeans started paying an extra three per cent on their purchases. The idea came in the form of an Economic Committee report that suggested that the country shifts from direct to indirect taxes because the then-high rates of corporate and personal income taxes (at 40 per cent) were seen as uncompetitive.

Then, in March 1993, the Minister of Finance Richard Hu officially tabled the Bill in Parliament to implement GST, which would start a year later in April. Looking through the archives, there were colourful labels given to the acronym, such as “Gasak Semua Tax”, which is loosely translated as “slap a tax on everything” in Malay.

Key arguments:

“GST is introduced to enable us to lower our corporate and personal income taxes to promote enterprise and growth, and to make Singapore a more competitive place for doing business. It is not about raising more revenue. The proof of this is in the package of tax reductions, rebates and subsidies that I have announced in the Budget Statement to offset the GST. These measures will ensure that practically all households would not be worse off after the tax.” — Richard Hu, Finance Minister

“People can ask for payment of [income] tax by instalments, but in the case of GST there is no such concession. Unless you do not eat, otherwise you will have to pay … GST is omnipresent and very pervasive. Even rice, salt, fuel, and every necessity in life is subject to tax. So it is like a large net. Every fish, big or small, will get caught. There is no question of willingness or not in this case. So the impact of GST on the cost of living is very important.” —Low Thia Khiang, WP MP for Hougang

Some support measures:

1) S$10.4 million more in grants for town councils so they would not need to raise service and conservancy charges due to GST

2) A S$700 personal income tax rebate in 1994

3) A three per cent cut in the corporate tax rate

4) Suspension or reduction of levies, such as the five per cent tax on domestic phone bills (suspended) and five per cent tax on Public Utilities Board bills of households in excess of S$40 (reduced to two per cent)

Estimated government expenditure in FY1993, before GST was introduced: S$15.5 billion

Other key taxes: Top personal income tax (30 per cent), corporate income tax (27 per cent), property tax (15 per cent)

Consumption taxes in some key countries: United Kingdom (17.5 per cent) and Japan (three per cent)

2003-2004: First GST hike

This was the first time GST was raised, and in two stages—from three to four per cent in January 2003 and to five per cent in January 2004.

The reason? PM Lee, who was then Minister of Finance, felt that the phased increase sends a better signal, giving Singaporeans more time to link the benefits from the support measures and the extra GST they have to pay. The government first seeded the idea of a tax hike in 2002 through an Economic Review Committee report.

The current tax hike also gives a feeling of deja vu because, like the Covid-19 pandemic, Singaporeans then were still reeling from the SARS crisis and a resulting economic downturn.

Key arguments:

“External conditions have been more difficult, and Singapore’s economic recovery less vigorous than we had hoped. This uncertain environment makes it more urgent and crucial for us to restructure and reinvigorate our economy. We cannot delay reducing our direct taxes, in order to boost businesses, retain talent, and generate economic growth and jobs.

If we cut direct taxes now, but postpone raising the GST until later, the government will not be able to balance its budget, or adequately provide Singaporeans with key public services, such as education, healthcare and defence.”—Lim Hng Kiang, Second Minister for Finance

“The GST is therefore a tax instrument to ensure that the government will continue to have a source of income from the people regardless of whether the economy is doing well or badly; it is a weapon which does not bother with whether our people are facing hardship or not … Is the loss in revenue from the cuts [in personal income and corporate taxes] so significant that GST must be increased? And should this be done at a time when people are already facing hardship?”—Low Thia Khiang, WP MP for Hougang

Support measures:

1) S$3.6 billion in Economic Restructuring Shares for eligible Singapore citizens above 21.

2) Town Council Service and Conservancy Charges rebates for five years for Housing Board households

3) Extension of utility rebates by a year

Estimated government expenditure in FY2002, when GST was raised in January 2003: S$28.3 billion

Other key taxes: Corporate income tax (22 per cent), top personal income tax (22 per cent), and property tax for non-residential buildings (10 per cent)

Consumption taxes in some key countries: United Kingdom (17.5 per cent), Japan (three per cent), and Australia (10 per cent)

2007: Second GST hike

The GST hike from five to seven per cent, a level which we are accustomed to, caught many by surprise when PM Lee first revealed the news in Parliament on Nov 13, 2006—including PAP MPs such as Zaqy Mohamed. And he wasn’t even speaking on a tax-related debate; the PM was making his speech during the debate of the President’s address.

Eventually, the government implemented the new tax rate on Jul 1, 2007.

Key arguments:

“We have brought [personal income tax and corporate tax] down to 20 per cent over a long period of time. In fact, we may have to lower them further. Hong Kong is competition for us. Their corporate tax is 17.5 per cent. They are thinking about GST. If they do a GST, they may decide to bring their corporate tax rate down, and we may have to follow suit.

The Central and Eastern European countries are also very competitive. Many countries in the former Soviet bloc, such as Poland, Hungary, Slovakia and the Czech Republic, have corporate taxes which are below 20 per cent … we need to consider raising indirect taxes, in other words, the Goods and Services Tax”—Lee Hsien Loong, Prime Minister and Minister of Finance

“While PM has asked us to delay judgment till we see the offset package, we know GST is a regressive tax that impacts the lower income much more and hence may diminish their ability to cope with globalisation.”—Sylvia Lim, a WP non-constituency MP

Support measures:

1) Senior Citizens’ Bonus ranging from S$200 to S$1,000 for those above 55

2) GST credits cash payout ranging from S$100 to S$1,000 to all adult Singaporeans

3) Top-ups to Public Transport Fund for lower-income households

Estimated government expenditure in FY2006, before GST was raised: S$30.6 billion

Other taxes: Corporate income tax (18 per cent), top personal income tax (20 per cent), and property tax for non-residential buildings (10 per cent)

Consumption taxes in some key countries: United Kingdom (17.5 per cent), Japan (five per cent), and Australia (10 per cent)