All photos by Mei Hui Lim for RICE Media

“Adulting”! It’s one of those millennial bits of slang that should probably go the way of “swag” and “cool beans” (In the bin.)

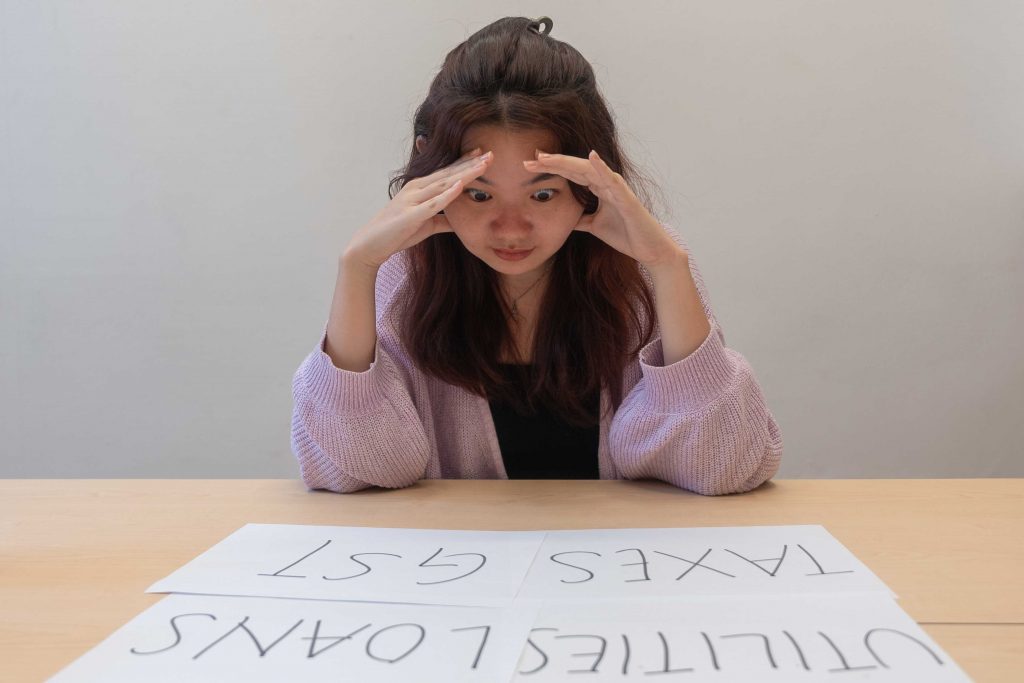

It’s a cutesy way to talk about the boring, and sometimes difficult, parts of growing up. Say these affirmations with me: It’s easy to book an appointment with the dentist, the knowledge of how to do my taxes does not evade me, and I can throw out the ‘O’ Level notes that have been sitting in a box above my cupboard for over 10 years.

It’s easy to make fun of cheugy lingo–I’m looking at the Zoomers–but it doesn’t detract from the emotional truth at the heart of it: adult responsibilities can be difficult to navigate. A big part of this is knowing how to manage your money. Getting a job is only the first step towards financial stability. There are a million other things you need to know: like how to save, how to invest, and even how to spend.

There is good news. Everything, including spending, can be optimised with just a little know-how. For example, using the right credit card can give you cash rebates. In simpler terms, cash rebates happen when your bank returns a portion of the money you spend with their card, which can offset your next bill. Think of them as discounts, just not from the retailer.

Cashback—as cash rebates are more commonly known as—is a key way to gain more control over your money. Once you get the hang of how it works, you stand to save hundreds of dollars a year, at the very least.

Give Cards Some Credit

Unless you’ve been living under a rock, you will have noticed that everything has gotten more expensive. Hawker food is the most expensive it’s been in 14 years. GST is set to rise another percentage point next year. Wages? Well, they aren’t really keeping pace with inflation.

Knowing all of this, what’s a young person to do in order to maintain an elite globalist lifestyle of budget flights and 1-for-1 buffet promotions?

Enter credit cards. Everything you’ve ever heard about them—that they may make it easy to exceed your budget, that you’ll spend more through paying off interest fees, that, as a result, you might face a lifetime of debt— won’t come true, so long as you spend within your means.

If you can trust yourself with the responsibility of paying your bills every month (and you should, because you’re a sensible adult now) credit cards are a surprisingly easy way to save real cash money.

The First Step of Adulting is Acceptance (and Setting a Budget)

The first thing you need to do is set a budget. Ask yourself these questions to determine your budget: How much of your money goes to bills? How much must you spend on luxuries? And how much can you absolutely not touch because it’s going to investments and cash savings?

The general rule of thumb is up to 50% of your income for needs, 30% for wants and the remaining 20% for savings, investments, and debt repayment. Countless apps have made tracking all of this shockingly easy.

However, depending on your personal situation, this may not work for everyone. For example, I live in my parents’ house (and head) rent-free, which drastically lowers the amount I need to set aside for my needs. This way, I can save a third of my monthly salary for an eventual mortgage or just a rainy day.

I set standing instructions for my bank account, so money is sent to my savings on a fixed date every month. I time it so I don’t accidentally spend that money when I’m not looking carefully.

Once you have your ‘disposable’ income for the month, you’re free to spend it however you like. While there are instances where cash is king, it’s actually a pretty good idea to do the bulk of your expenditure on credit cards.

Yes, I know how it sounds. Just stay with me on this.

Getting Cash from Spending Cash

Every credit card comes with benefits that you can use to your advantage.

When I was a teenager, the Internet still hadn’t permeated everyday life in the way that it does now. Don’t get me wrong, I’m not from the era of fax machines. But online shopping wasn’t as convenient as it is today.

Back then, buying something off the Internet was only available to people with certain debit cards and/or permissive parents. When my cohort of peers finally got our own cards, we relished the chance to buy any random product that crossed our screens.

I really mean random. Someone I know bought a set of 26 plastic animal figurines, one for each letter of the alphabet. He regretted the purchase once they arrived, but if he had access to cashback rewards, his regrets would have been far less dramatic.

So, here’s where we show you how cashbacks work. As this piece is produced in partnership with UOB, we’ll be using their range of cards to demonstrate how cashback can feel like a crucial money-saving tactic. Ultimately, with your own needs and preferences, you make the choice. That’s just part of adulting!

Here’s Where the Fun Begins

Now, if any of my friends had made their frivolous purchases on a card like the UOB EVOL Credit Card, they could have had 8% of the spending back in cashback.

In fact, the UOB EVOL Credit Card offers 8% cashback on all online and mobile contactless transactions. We’ve all had impulse buys where returning them just isn’t an option. Your cashback credit card won’t take the pain away—but it will remarkably lessen the blow.

The good news here is that the UOB EVOL Credit Card cashback applies to every online or mobile contactless transaction (such as Apple Pay and Google Pay) you make. That’s effectively an 8% discount when you shop, as long as you hit a minimum spend of $600 (take note of the $20 cap per category as well).

There’s also no annual fee for owning the credit card as long as you use it for at least three purchases every month. Considering how many cards on the market charge close to $200 annually for their cards, you should definitely consider the fee waiver as a discount too.

When I got my UOB EVOL Credit Card, something I discovered was that it also allowed me to earn higher interest on my savings. Once I started spending a minimum of $500 per month on the card, my UOB One Account began earning higher interest.

Besides earning cashback on my credit card, I am also earning higher interest rate on my UOB One Account, so be sure to read up on all the benefits you can get before signing up for a new account. You’ll never know what you might miss out on otherwise.

For the uninitiated, interest is the money you earn on the savings in your account. By spending on my linked UOB EVOL Credit Card, I unlocked a higher interest rate and began seeing bonus interest credited every month. The interest rate earned increases with your monthly balance as long as you fulfil two very simple steps (just in case you need yet another incentive to save more of your money).

If you’re good at saving, you stand to benefit up to 7.8% per annum (p.a.) interest. The exact interest rate varies, depending on your account’s monthly balance and whether you spend on your UOB EVOL Credit Card plus credit your salary or make 3 GIRO transactions. But fret not–your first $30,000 will already qualify for a 3.85% p.a. interest rate, making this a great option for people at the beginning of their careers (that’s, of course, with a minimum monthly salary of $1,600).

The fine print will reveal that, to qualify for this, some minimum expenditure (to the tune of $500) on your UOB EVOL Credit Card is required. Reading is important!

The cashback doesn’t stop here though. I did a little digging into UOB’s other offerings and I’m pleased to share my research with you. You might find my main finding counterintuitive but stay with me.

In my view, the best way to use credit cards is to adopt a multi-card strategy.

M-… More Cards?!

Yes, I’m telling you to sign up for multiple credit cards.

Basically, your credit card strategy should resemble a Swiss army knife–different tools for different purposes. Credit cards all have different benefits, but these are often capped at a certain spend amount or are dependent on spending categories. The smartest way to use your cards is to maximise each card’s specific bonuses.

The UOB EVOL Credit Card I love so much has a cashback cap of $60 a month. This adds up to a whopping $720 a year. However, the cap also means the UOB EVOL Credit Card might not be the most strategic card for larger expenses.

For larger transactions, the UOB Absolute Credit Card would work much better instead. It has a comparatively lower cashback rate of 1.7%, but the cashback is limitless, and, unlike many other cards, UOB Absolute doesn’t stipulate any spending category exclusions—with no minimum spend as well.

This means that you can expect cash rebates on typically large bills: school fees, insurance premiums and medical appointments. It can also apply to large purchases like holiday bookings, home furnishings, and wedding expenses.

There are a multitude of potential credit card perks. So how do you choose what to focus on?

This is where it’s important to understand what sort of spender you are. If you’re the responsible member of your household, you might want cashback for the daily or monthly essentials.

The UOB One Credit Card has one of the highest cashback on daily essentials–fast food (McDonald’s), groceries (DFI Retail Group (Giant, Cold Storage, CS Fresh, Jasons Deli, 7-Eleven, Guardian)), transport (Grab, SimplyGo (bus and train rides)), shopping (Shopee), UOB Travel transactions and utilities (SP Group).

In fact, until 31st December 2023, the UOB One Credit Card is offering up to 15% cashback on daily favourites for new-to-UOB Credit Card members. It’s the perfect way to get started if you’re planning your debut in the world of cashback.

To add to the responsible-ness, the UOB One Card also offers free travel insurance (sign-up required) for trips charged to the credit card, as long as it’s the entire travel fare. And, with up to 10% cashback on all SimplyGo transactions (public transport fares charged to contactless cards and mobile devices) that’s more incentive to head home before the last train leaves.)

Banks also have apps to let you keep track of your expenditure on every card. For example, the UOB TMRW app is where you can pay your bills and get a bird’s eye view of all the money you’ve been spending. Streamlined for your adulting convenience.

Much Ado About Adulting

Let’s be so for real: adulting can be pretty painful. Paying bills is a pain, showing up for meetings that should have been emails is a pain, and wondering how your secondary school friend could afford that destination wedding might exacerbate all the pains in your daily life you can think of. There’s a lot about growing up that we can’t really control. But it doesn’t mean it’s time to lie down and be helpless.

One concrete step that you can take to feel steadier as an adult is getting a handle on your finances. Knowing where you can earn cash rebates or take advantage of a promotion is a useful skill that will help you gain confidence with using credit cards.

Once that’s squared away, you’re free to actually enjoy the best thing about being grown: spending money.