What if … you can go back in time, notice someone siphon US$4.5b in cash value from everyone else’s accounts, including yours, and then transfer it into his? Collectively, you and everyone else can red-flag and freeze that man’s account in real-time.

Unfortunately, our current reality doesn’t give us these options. We don’t see these money trails, let alone stop a heist as it happens. Every monetary transaction today is private and invisible. So we trust our bankers, regulators and authorities to red-flag and check on our behalf. Sometimes, it may be too late.

In 2009, someone named Satoshi Nakamoto changed this. It was during the Financial Crisis, where our trust in the banking system was on the brink, and he wanted to remedy it.

He built an alternative, where every account owner on that network is forced to publicly share his account records from day one. He made the network immutable, so no one can alter the value in these records (forgery) or transactions (theft).

This is essentially the blockchain concept. It drives the cryptocurrency Bitcoin, and to some extent, alternative coins (altcoins), like Ethereum and Litecoin. Simply put, cryptocurrencies are meant to be monetary systems built on collective trust. They are also meant to be faster and cheaper.

This alternative way of perceiving money (ie. assets and transactions) attracted the attention of governments and companies like Facebook, Temasek Holdings, Ubisoft and even Central Banks. So yes, after 11 years since Nakamoto’s Bitcoin genesis transfer, some perceptions did indeed change.

But how will this impact you? What can you gain if you open a Bitcoin account now? Tomorrow? Would it provide you with a safe and secure alternative monetary system outside of your current trust in banks, stocks, gold and savings?

What Can I Do With a Bitcoin Wallet Today?

Ask any cryptocurrency user today and they will tell you that Bitcoin, and to some extent, altcoins, are an alternative way to store monetary value. Some call it ‘digital gold’. These coins “hodl” the promise of hope.

Launched just 3 to 4 years ago, most of these cryptocurrency projects function like any startup or Kickstarter endeavour. Join any project’s Discord or Telegram channel, and you’ll see supporters harbouring hopes for the project’s coin value to rise when it gains adoption.

With more than 5,000 altcoins in the crypto-sphere, it’s really anybody’s guess.

One thing’s for sure, as each coin promotes a ‘vision’ of what a blockchain should look like, or how it can transform the ecosystem, some users are already benefiting from it.

“There are people, especially the unbanked or living in third-world countries, who have no access to banks or financial instruments,” said Jorden, a Coinhako user since 2017. “Many saw Bitcoin as a potential avenue of sorts, especially if they started in 2017 and then 2018, and experienced life-changing moments at the time.”

Jorden’s right. For many people who lack the credentials to open a bank account, or have no access to a financial broker, cryptocurrency seems like an avenue to build wealth (ie. store of value).

But, as a day-to-day mode of payment to replace cash or credit? It still has some ways to go.

The decentralized nature of cryptocurrencies means coin values are determined purely by market forces (read: price volatility). So pricing a cup of latte at 0.01 Bitcoin may change in value one minute to the next.

To get around this, many cryptocurrency exchanges (where you buy and sell cryptocurrency), spawned stablecoins, and pegged them to a stabler currency like the US dollar, hoping to give them less volatility.

For Jorden, since he only uses his cryptocurrency as a store of value, he sometimes loans them out (“staking”) through a company specializing in matchmaking crypto-lenders and cash-borrowers. “On a month-to-month basis, I do not need to buy or sell my crypto. So I stake it on a crypto-for-cash lending platform, where a borrower could get a much-needed emergency cash loan, while I stake my cryptocurrency as guarantee while earning interest off it.”

Another Coinhako user, Leslie, 43, sometimes does staking as well. In cryptocurrency circles, terms like Proof of Work/Proof of Stake, forks, mining, TPS, nodes and decentralized/centralized are usually peppered in conversations.

In this case, staking means “pledging cryptocurrency as a collateral (or commitment to the project), while earning some form of incentive over a set amount of time”.

While there are many lucrative ventures on how one can use their cryptocurrencies to earn incentives—the general concern is if they are being used for illicit means, due to its pseudonymous nature.

You see, while records and transactions are publicly viewable, individual wallets are anonymised. Each wallet can only be unlocked using a unique, cryptographic private key, so personal identities are hidden.

This could breed situations where someone steals another person’s private key or uses anonymity to launder money. So we do need better laws to protect users.

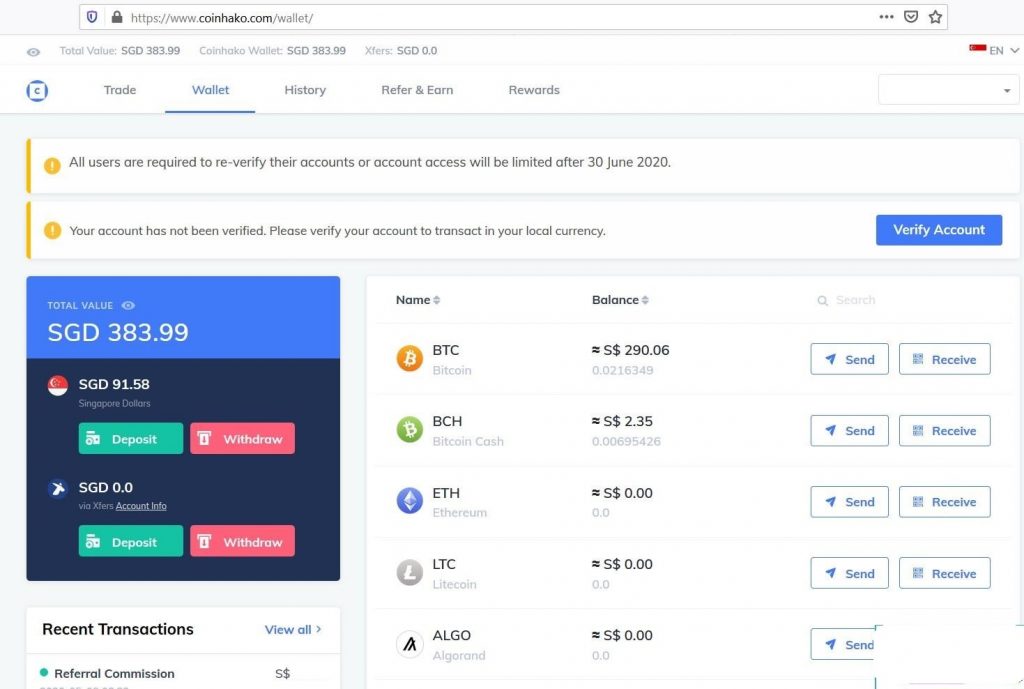

In Singapore, one such law is the Payment Services Act. It includes a licensing structure for Singapore-based cryptocurrency platforms like crypto-wallet service Coinhako, which gives customers the added safety net they need.

This includes Know-Your-Customer (KYC) steps, where users register their real identities in support of anti-money laundering (AML) policy.

As a registered and verified user, you may no longer be anonymous to Coinhako, but you can be assured that the platform is here to stay, since no one would dare steal or launder money through cryptocurrency when accounts are logged.

“KYC is a good thing,” said Edward Choy, 40, another Coinhako user. “It gives a semblance of legitimacy to something that mainstream financial institutions are deeply suspicious about.”

“KYCs are important for AML to function properly,” Leslie elaborated, “when you couple this with proper legislation, it will encourage businesses and partners to trust the platform, improve its network, and hence, benefit users within the ecosystem over the long term.”

But, enough about the serious stuff—cryptocurrencies actually have some feel-good, altruistic uses after all.

Today, with a cryptocurrency wallet, you can support social causes like Direct Relief and The Water Project. This is helpful because the transaction is recorded on an immutable network, so you’re assured that it reaches their wallet (and not siphoned off in middlemen commissions en route to where it really matters).

Despite its price fluctuations, Bitcoin has gained a slow but steady acceptance as a form of payment among merchants worldwide. Travel companies like CheapAir, Richard Branson’s Virgin Galactic, food delivery services like Germany’s Lieferando, online software and gift card services like Microsoft, BigFishGames, Twitch and Bitrefill have been accepting Bitcoin for some time.

Closer to home, Ryde, Singapore’s carpooling app, now accepts Bitcoin as payment to top-up RydePAY accounts. If you’re headed down to Kopitiam at Funan mall, you can buy your favourite local dishes using Bitcoin or Ethereum via its KOPItech kiosk. More recently, PayPal was reported to have plans to roll out cryptocurrency services to its 325 million users, which, if true, is a big deal for mainstream adoption.

Meanwhile, outside of the cryptocurrency craze, we’re seeing blockchain technology being used in profound ways to improve authenticity. They may not have a direct impact on the cryptocurrency you own in your wallet, but their adoption means a better ecosystem of trust overall.

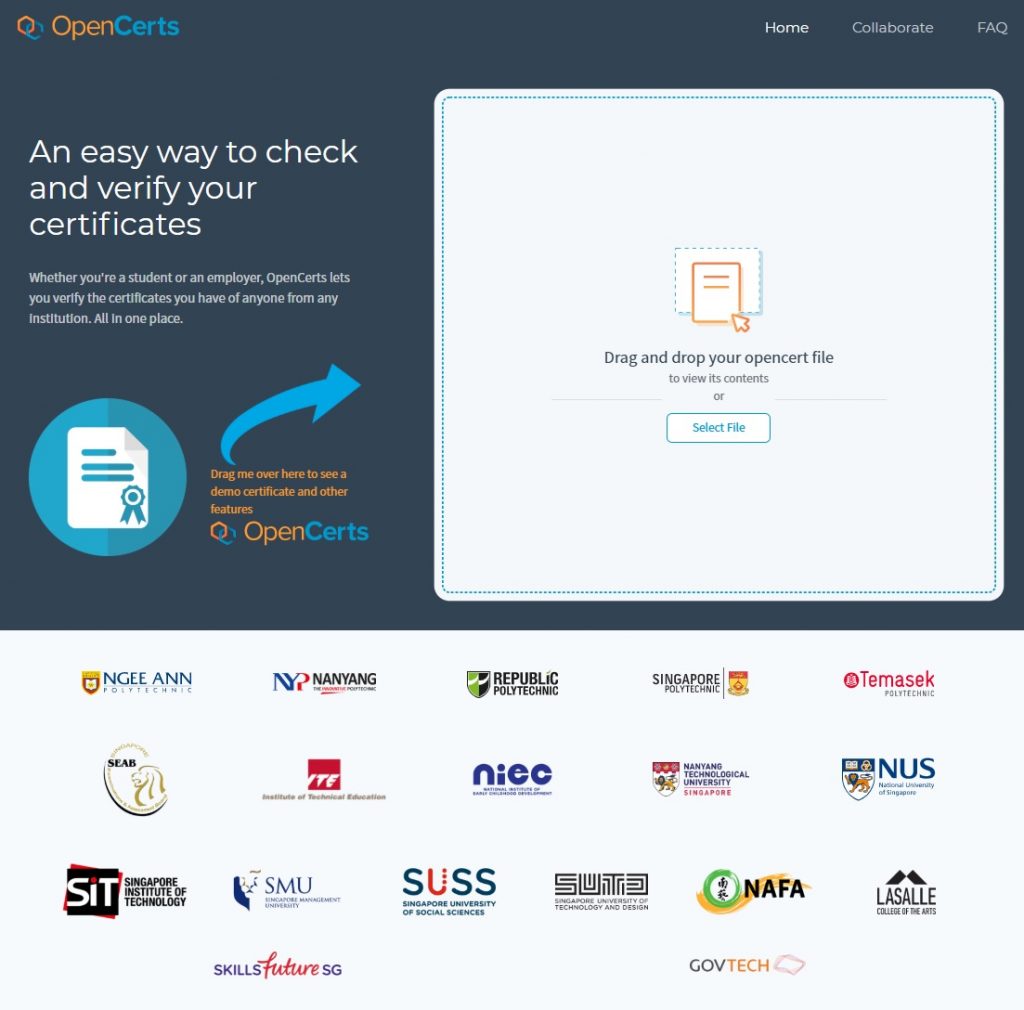

For example, in Singapore, IHLs like polytechnics and universities are using blockchain to keep permanent records of your graduation certificates (because you always lose the physical paper after a while, right?).

Called OpenCerts, it’s a blockchain initiative where potentially, an employer can verify the authenticity of the certificate without asking you some really uncomfortable questions. Did you really graduate with a PhD from so-and-so university?

Elsewhere, electorates in Japan, USA, Russia and Switzerland have conducted voting experiments as a demonstration of tamper-proof voting (no more recounts). The UN Food and Agricultural Organization (FAO) uses blockchain to track seafood from dock to dish (sustainable resource).

Those Chinese premium Fuji apples you’ve been buying off your NTUC Fairprice outlet? Each apple usually comes with a QR code sticker, so consumers can scan and verify its Good Agricultural Practices (GAP) and origins. It’s also been done for durians, and soon, avocados and citrus, thanks to DiMuto and Google Cloud. Yeah, this is happening in our backyard already.

All of these sit on varying layers of proof, validated by every node supporting that blockchain network, and the records stay there forever.

You may shrug off these use-cases as mere experiments, but in the golden age of e-commerce, it’s critical that we start finding better ways to trust our transactions, be it digital currency, in-game assets or real-world apples.

Once it permeates our way of life, it will then co-exist with our existing financial and distribution systems, promote transparency in how we interact and cross-trade at the individual, corporate and international level.

What Can I Do With a Bitcoin Wallet Tomorrow?

Speaking of wider mainstream adoption, some regulators and lawmakers are now more accepting of cryptocurrency and blockchain. In the past, they’ve been seen as wet blankets, but not anymore.

In the financial sector for instance, central banks are exploring the use of CBDCs, or Central Bank Digital Currencies.

It allows central banks (and governments) to even out variations in money settlements. This is useful in situations like foreign worker remittances (ie. cross-border payments), where different money-lending banks have to square-off on rates, which could take days. With blockchain and CBDCs, clearance should be quicker and interbank disputes even less.

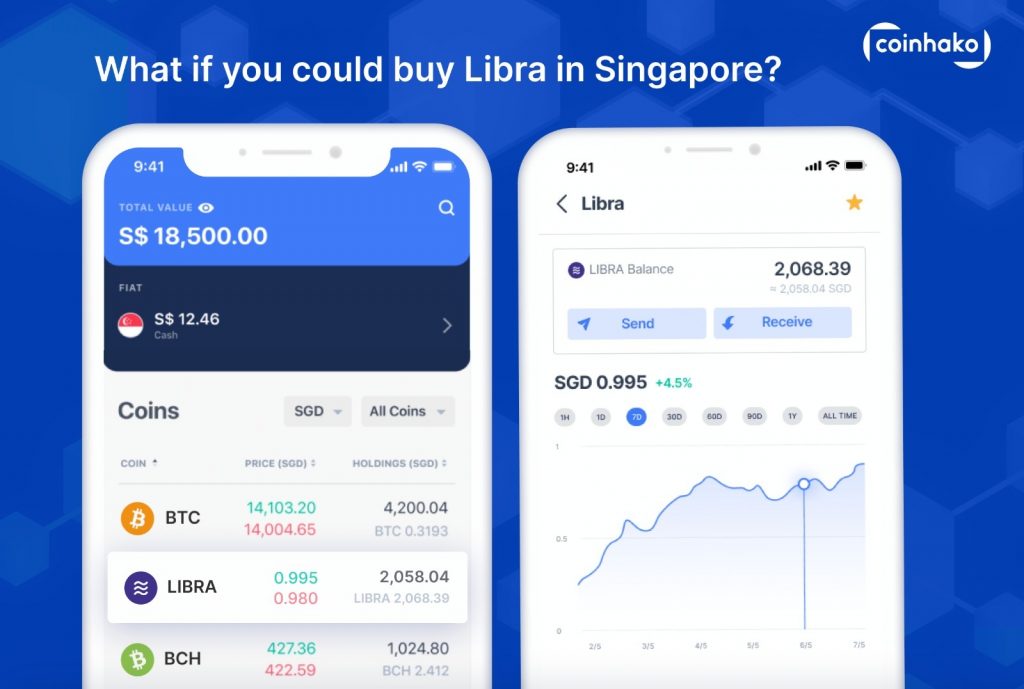

On the social media front, Facebook has Libra, a permissioned blockchain digital currency platform. You know something’s up when Singapore’s Temasek Holdings plonked some moolah into it this year.

The difference between permissioned and permissionless is that for the former, validation of transactions is made only by approved and trusted nodes (data centres or computers keeping the network alive).

As opposed to Bitcoin, which is permissionless (where anyone, anywhere can run a Bitcoin mining node), it’s meant to be faster, more trustworthy and centralized (ie. less volatile).

According to Edward, one positive thing about Libra is that it’s a viable, non-country-specific currency that isn’t held hostage by political volatility in the country’s leadership. His qualm though is corporate sovereignty, especially if Libra is being used for commercial profit, rather than convenience.

So the good news for you is Libra may be used on Facebook’s platform (including WhatsApp and Instagram) for digital transactions (sort of like in-platform currency). TikTok also seems to have plans, so expect great things in the social media space soon.

What Can I Do With a Bitcoin Wallet Next?

The next phase is really improvements in technology at all levels—individual, corporate and government.

This includes security, transaction speeds and how each cryptocurrency project (especially the ones with committees like Ethereum and Libra Association) solidify their infrastructure for real-world applications.

Despite early naysayers, some highs and lows, booms and burns, the ecosystem is here to stay. In fact, service providers like Coinhako will play a vital role in this. As blockchain-based solutions like Facebook’s Libra become part of everyday, mainstream usage (potentially 2.6 billion users), service providers’ role in keeping the system alive is key.

From conversion of fiat (cash) to cryptocurrency, wallet-to-transaction services, exchange trading, security monitoring to node validation on the blockchain, we’re just one major crypto-project away from mainstream adoption. When that happens, the way we trust and transact will definitely be transformed.

All of the Coinhako users I spoke to are long-term believers of this ‘vision’. The key, they said, is to stay level-headed and not get easily swayed by short-term “noise” (aka speculation).

“Getting involved in cryptocurrencies has taught me to manage my emotions, both good and bad, better than before. I’ve learned to always have a plan, be it in crypto or in life. When I involve myself in a project, even if it’s stock trading, I do it with a calm and cool head. I develop a plan and mentally prepare myself in case of setbacks,” said Jorden. “You don’t want to set yourself up and go into “revenge trade”, where you sink even deeper, have difficulty climbing out, start complaining and ruin relationships. It’s quite scary.”

“I’m actually surprised I can actually buy and hold something over the long term,” said Edward, when it comes to trading. “I’m just a much more patient person these days.”

After just 11 years of thriving alongside more developed centuries-old financial systems handling trillions of dollars of investments, this alternative financial system deserves far more credit than we give it today.

This article is sponsored by Coinhako.

You can check out some of Bitcoin’s latest developments at Coinhako.