What defines a Zoomer?

‘TikTok’ and ‘memes’ are probably the first words that come to mind. ‘Digital natives’ another. Just picture kids born between the years 1996 and 2012. Teenagers, students, and recent grads with smartphone-like appendages, baptised from the cradle in the holy waters of Wi-Fi.

In Singapore, Zoomers are a rapidly spawning segment of the population. According to McKinsey, by 2025, Gen Z will constitute the same share of Asia’s population (25 percent) as Millennials (born between 1980 and 1995).

At RICE, this leads to some hostility whenever the subject of Gen Z is brought up. If you haven’t noticed, RICE is largely a Millennial-run outfit—with a few Gen Xs sprinkled in to keep us fresh.

So when our Supreme Millennial Editor, Julian, informed us one morning that we had an intern from the Class of 2020 who would be joining us the following Monday, murmurs of discontent were heard around the Zoom conference table.

And since none of us were ‘qualified’ to write about Gen Z, this article on Zoomers (the one you’re reading right now) would be assigned to her.

Immediately, I unmuted myself to object.

Asking a Zoomer to pen an article about themselves may look very credible and official on paper, but without a frame of reference, the end result would still be incoherent gibberish.

No, what we need is a Millennial Ambassador to help bridge the gap between our two species. Someone who can provide English subtitles to this anime adaptation.

I volunteered myself as tribute.

How Gen Zs See the World

When I spoke with our intern Yin Lin, 22 in early May, via Zoom video conference, she certainly looked and sounded human.

Yin Lin is part of the NUS graduating class of 2020, with a major in Linguistics. Her commencement, which had been scheduled for July, was cancelled. When we last spoke, she was still in the process of moving out of her dorm.

“When I see my juniors being upset over their disrupted plans, I’m thinking, ‘child please’,” she said. “Look at the class of 2020 and the job market we’re graduating into.”

It’s no understatement to say that the world is a mess right now. The Covid-19 economic downturn may even be worse than the Great Financial Crisis (GFC) experienced by graduating Millennials.

Among Zoomers, there’s a general confusion about their career and financial prospects. Most of them don’t know where to turn for help. As the first generation born into the digital age, the wisdom of older generations feels almost outdated in the gig economy.

Talking to Yin Lin about the Gen Z job market is a classic chicken-and-egg problem.

Employers today are looking for experienced candidates, but Zoomers can’t get experience without first getting a job.

It’s hard for some of Yin Lin’s peers to even begin their search. Most businesses have freezed hiring, and when positions do open up again, they will be competing against a huge backlog of qualified and experienced candidates. Yin Lin was fortunate to have contributed to RICE as a freelancer during her university days, which was what landed her this internship.

“In Singapore, everyone is obsessed about getting a decent salary for their first job,” said Yin Lin. “Most people in my graduating class are aiming for S$4,500 per month, but I’m not sure how realistic that is. It really depends on what field you’re going into.”

After the GFC and the Covid-19 economy, the distinction between the Zoomer and Millennial experience feels almost arbitrary.

“There’s no point in separating Gen Z and Gen Y,” concluded Yin Lin. “We’re both Generation F.”

Savings? What Savings?

The same cart-before-the-horse logic applies to personal finances.

Zoomers want to learn how to manage their money, but to do so, they must first have money to manage. Most graduating Zoomers like Yin Lin don’t even know the right questions to ask. Her younger peers are even less sure.

“Yeah, I’m not that financially literate,” said Yin Lin. “I think that’s a problem with many Gen Zs. The first people I turn to would probably be friends, and then my parents.”

But Yin Lin understands that part of growing up means peeling away from ‘FMS’ (Father-Mother-Scholarship). Very soon, she will have to face the reality of paying for – or at least contributing to – bills and expenses, as well as squaring away debts she may have accumulated during her student years.

Starting early in the savings game is a definite advantage and can offer Zoomers more financial options down the road.

For Yin Lin, however, that doesn’t mean taking the first job that becomes available. As a Gen Z, she is hesitant about trading away her early years for a boring desk job with limited relevance to her long-term career goals.

“For me it’s about finding a job that’s meaningful. Something that I enjoy doing,” explained Yin Lin. “Growth is more important. It doesn’t have to be the highest paying.”

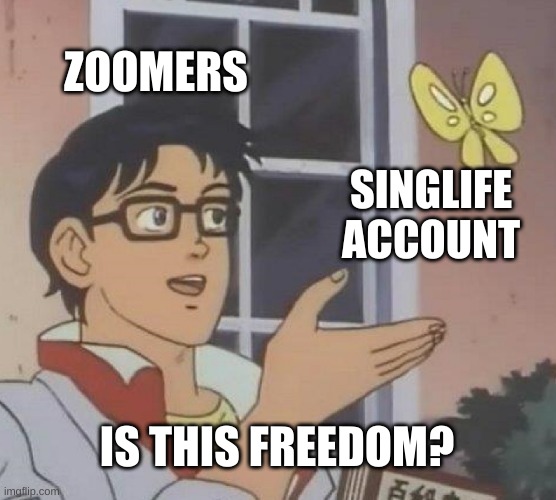

To aid her in this pursuit, Yin Lin is looking for financial products that offer attractive returns so that she can spend her time on personal growth rather than worry about her finances.

“I just want to be more carefree, and for all interactions with my financial provider to be simple and easy,” said Yin Lin. “This means not worrying about lock-in periods or fees. When I need money for a big-ticket purchase, I don’t want to worry about withdrawal penalties.”

A Millennial’s Advice to Graduating Zoomers

Recession or no recession, my only words of wisdom to Yin Lin and other graduating Zoomers is that life only gets harder from here. Years from now, when they look back on their student days, all of this will seem like a nostalgia-filled paradise. Before ‘LIFE’ and ‘REALITY’, in capital letters, got in the way.

On a more positive note, graduating Zoomers will also have more freedom to shape their own destinies. This can be a double-edged sword. What this means is that you’re free to pursue the things you want, but no one can guarantee your success. No matter how hard you try, the world isn’t always fair. Sometimes it all comes down to luck.

Most importantly, in any given week, you’ll have a limited reserve of energy. So try to focus on the 2-3 things that matter the most to you, and make everything else in your life as simple and streamlined as possible – especially when it comes to your finances.

The Singlife Account, for example, it’s an insurance savings plan that goes a long way toward simplifying your financial life.

It offers a fuss-free digital experience by allowing Zoomers to manage their savings easily on a mobile app; currently, it offers 2.5% p.a.^ returns on the first S$10,000, while providing life insurance coverage up to 105% of the account value.

It has no lock-in periods and comes with a complimentary Singlife Visa Debit Card that gives you ready access to your money and no FX fees (for overseas transactions).

It is the first step Zoomers can take to achieve the next best thing: financial freedom.

Beyond this, I have no real words of wisdom to offer.

After the year we’ve experienced, it’s scary to think that the worst might still be on the horizon. A storm that might make all Singaporeans, regardless of age, question our ideas of what’s ‘normal.’

To quote Haruki Murakami from Kafka On the Shore:

“When you come out of the storm, you won’t be the same person who walked in. That’s what this storm is all about.”

Who would have thought that an insurance savings plan could offer young savers some shelter from the rain?

This post is sponsored by Singlife.

Find out more about Singlife Account, the insurance savings plan here.

^ 2.5% p.a. returns on first S$10,000 | 1% p.a. returns on amounts above S$10,000 | There are no returns for amounts above S$100,000. | Crediting rates (returns) are not guaranteed.

The information is meant for your general knowledge and does not regard any specific investment objectives, financial situations or particular needs any person might have and should not be relied upon as provision of financial advice.

Singlife Account is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact Singlife or visit the LIA or SDIC web-sites (www.lia.org.sg or www.sdic.org.sg).

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Information is correct as at 4 August 2020.