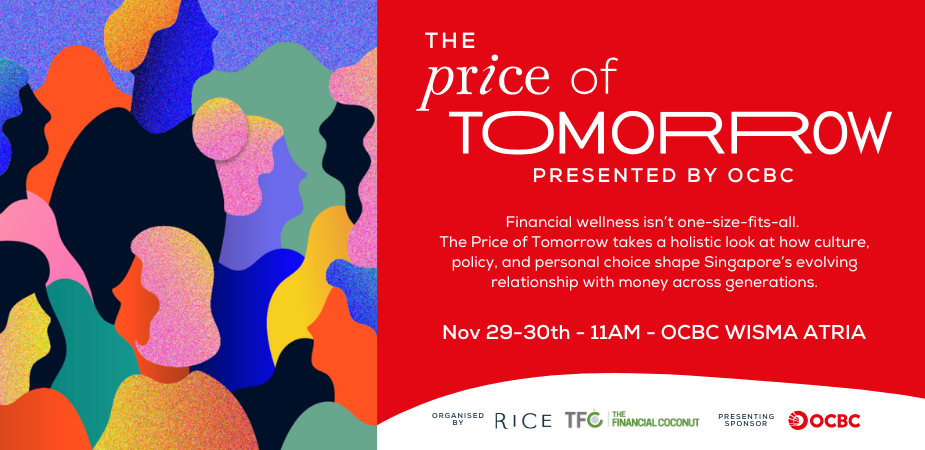

The Price of Tomorrow presented by OCBC is a financial wellness festival held in conjunction with The Financial Coconut and RICE Media to take a holistic, human look at the role of money in our lives.

All images by Yee Jia Ying for RICE Media.

Teetering on the edge of bankruptcy was a period of uncomfortable clarity for 48-year-old Eddie Jui.

Not only did his intellectual property services firm collapse during the Covid era, but he also had to liquidate his insurance policies to pay off his debtors.

As someone who prides himself on being honest and hardworking, Eddie struggled to understand how he had ended up in such an embarrassing and precarious position at 43, unable to provide for his wife and two young children.

Those long nights of reflection eventually led him to examine something deeper: his relationship with money.

“I came from a poor family, whose understanding of money was very superficial,” Eddie shared with the audience at a live panel discussion at 27 Ann Siang as part of OCBC’s The Price of Tomorrow financial wellness festival.

He was candid about his experience growing up in a rental flat, in a family that survived from paycheque to paycheque. Eddie had observed his parents trying to escape poverty not by earning more but by consuming less, trimming their lifestyle down to what was strictly necessary. A small fish caught from a nearby lake was his version of luxury as a child.

“As I reflected, I realised that throughout my career, my savings never crossed the $5,000 mark. That’s when I knew I had to redefine my concept of money.”

Motivated to give his family a better life—and determined to unlearn the habits that had trailed him since childhood—Eddie began reading up on personal finance. Today, he earns a decent living driving a taxi while hustling as a content creator for his popular YouTube channel, LazyCabbie.

At the panel moderated by LinkedIn influencer and podcaster Adrian Tan, fellow panellists Dr Annabelle Chow, Principal Clinical Psychologist at Annabelle Psychology, and Elaine Teh, Head of Deposits at OCBC, echoed Eddie’s sentiment: The habits we pick up as kids significantly shape how we spend and save years later.

And when it’s our turn to be parents, those old instincts slip out and get passed down before we even notice.

Financial Literacy, But For Kids

Adrian chimed in with his own confession: he grew up around spendthrift role models, but it was only after his own plunge into debt with multiple banks that he became intentional about teaching his four kids financial literacy.

“I wrote on the glass panel of my wardrobe how much I owed to each bank—not only to manage the repayments, but also to remind my children not to land themselves in such a situation,” he said.

Yet, teaching kids about money today is trickier than simply handing them a piggy bank. Adrian grew up in a world of notes and coins; his children live in one ruled by tap-and-go transactions.

Still, he’s grateful that banking apps let him keep track of his children’s spending.

“I can monitor what my kids spend on through my app—and it’s also become like a leaderboard of who has more money (in their accounts),” he joked.

Elaine agreed that digital payments today could complicate things for parents, especially when it comes to teaching kids the actual value of money.

“With my digital banking account, I let my children be exposed to modern financial management,” she said.

She shared that her own children were quick to embrace cashless payments—too quick, at times. But as their curiosity grew, in-app tools enabled her to gently nudge them in the right direction.

“Some kids might tap and tap, but their spending can be monitored. And that’s where we can guide them.”

Elaine wasn’t simply offering product advice. She was making a broader point: when money becomes just numbers on a screen, parents need systems that restore a sense of value—and today’s tech actually provides reliable tools to teach kids the fundamentals.

“What if banking apps vibrate more strongly according to how much children spend, so parents can keep better track?” Eddie asked, half in jest.

“But what if children like it?” Elaine shot back, sending the room into laughter.

Still, she emphasised that these modern tools, which allow parents to monitor and review transactions in detail, help families cultivate intention in how children spend and how parents teach.

The Hidden Messages We Send About Worth and Wealth

From practical advice, the conversation slipped into more intimate territory: the childhood lessons that shape our lifelong relationship with money.

“Everyone’s circumstances are different; thus everyone’s perception of money varies,” said Annabelle. An austere childhood, she noted, can create a scarcity mindset, while a lavish one can lead to generosity—or overspending.

“The lessons and values about money—how were they communicated to you?” she led the room to ponder.

The psychologist explained that when parents weaponise money—penalising children by deliberately withholding spending—it can also create lifelong hangups.

“When parents punish children by spending on everything except the child, the child may equate a lack of spending with a lack of love,” she shared.

“If you put cotton wool in coffee, then take it out and put it in a glass of water, the cotton wool will still remain stained.”

Through this analogy, she explained how early experiences, whether explicit or implicit, become difficult-to-remove imprints on our adult behaviour.

Even knee-jerk reactions, Annabelle pointed out, can leave deeper scars than parents realise.

She added that children often adopt beliefs from offhand parental comments. Simply saying “no money” to everything, for example, can lead them to internalise that scarcity as a personal reality.

In moments of frustration, she advises parents to “take a step back and take a deep breath to dissipate the cortisol.”

“When we pause to think about how to handle a situation better, we can inculcate stronger anchor values in our children.”

Highlighting that the brain and its habits are largely formed by the age of 25, Annabelle reiterated the need for parents to be mindful of what they relay to their children—both consciously and unconsciously.

Yet, she emphasised, healthy habits can always be relearned.

What We Can and Cannot Control

In Eddie’s case, that relearning has already begun. Today, expenses are an open discussion that involves the whole Jui household.

Eddie tries to turn everyday situations into subtle lessons: why the same shampoo costs differently depending on where it’s bought; why lights should be switched off in empty rooms; why Dad sometimes has to work longer hours.

“By explaining to them why I have to work a certain number of hours, they’re learning the value of money.”

Annabelle shared that she uses similar teachable moments with her own children.

“My rule is: if we have it at home, think carefully if you need to buy it,” she said.

She recounted a tender moment when she almost scolded her son for buying more Yakult even though they had cartons at home.

“I told myself: shut up, be present, and be curious.”

When she asked him why he bought them, he replied that he wanted to share a new flavour with her. She admitted she was grateful she hadn’t snapped.

Annabelle also plays make-believe money games with her kids and involves them in grocery trips. “When they’re part of the journey, I can talk them through the thought process and teach them how to spend within their means.”

These moments are deliberate, she said—not only to educate her children, but to deepen their relationship.

While the panellists offered practical pointers for introducing kids to financial literacy, they also acknowledged the environmental forces shaping young minds today.

Elaine noted that millennials grew up learning about money through physical transactions, but today’s kids learn “by asking ChatGPT and DeepSeek.”

Even popular video games for children these days, like Roblox and Minecraft, teach children how to accumulate and spend credits, she observed.

“Their exposure to finance is very different,” she said. “But once you see them applying intent, that’s when you can give them a real bank account.”

Annabelle added that birth order also plays a part in shaping financial habits: “The first child receives two-to-one attention, so they tend to take after their parents. Younger siblings tend to learn from the older ones.”

In other words, there’s only so much that a parent can do to instil healthy money habits among their kids. Mistakes will be made—they’ll still overspend and make bad financial decisions, just like we did.

But the point was never to create perfect, disciplined children. The point is to help them build a sense of value sturdy enough that, when they do mess up, they know how to steady themselves.

Outgrowing Old Habits

Elaine recounted growing up with prudent parents who taught her to “save for rainy days and think thrice before spending.”

Now raising children of her own, she says she’s less tight-fisted, but she tries to help them see the value behind their desires.

“If my son asks for a $300 Pokémon card, I’ll ask him to think about what that amount represents in terms of everyday necessities.”

Still, it’s worth remembering that kids aren’t the only ones who need to be inculcated with positive money mindsets. Regardless of age or life stage, most of us could use a clearer way of thinking about money.

The world will keep shifting with new platforms, payment systems, currencies—even new ways of earning and spending. But beneath all that churn, the basics stay the same. People still need to know what they have and what they can’t afford to lose.

Eddie’s midlife regrets make one thing clear: bad habits don’t disappear just because we grow older. Unlearning those patterns is often harder than teaching new ones, but it’s the only way to stop passing them on.

“This is what I want to remind my children: Don’t attach anything to the dollar bill other than its monetary value,” Eddie reflects.

“Money is just a tool to facilitate transactions; it does not denote their character. Money doesn’t build dreams; aspirations do.”

The Price of Tomorrow presented by OCBC is a financial wellness festival held in conjunction with The Financial Coconut and RICE Media to take a holistic, human look at the role of money in our lives.