Note: This is the third part of a series on financial literacy and ETFs. Here’re the first and second parts.

Till today, once in a while at least, I would pull out my Magic The Gathering (MtG) album and gaze transfixed at the black-framed collector’s edition cards I own. If you’re not in the know, MtG is a popular and competitive collectible card game that blends slick artwork and strategic gameplay, which became extremely popular in the early 1990s. It is still massively played today, with online versions on mobile and PC.

Anyway, my cards have been preserved since I was a pimply-faced Polytechnic student in 1993. Short of owning a Black Lotus card—the mother of all MtG cards—my collection now commands a respectable value if I choose to put them up for sale.

What’s even better, is that the Russo brothers (who did the Marvel Cinematic Universe two-part Avengers films) will be creating an animated series of Magic The Gathering for Netflix. Who knows? Maybe we’ll see a resurgence in value for mint-condition MtG collectible cards, especially the ones I’ve kept since 1993.

But where am I going with all this? Well, for starters, everything we do and invest our time in life has a perceived value. It gets better if everyone else sees that value the same way I do, like MtG cards.

With the investments I’ve made since I started earning my first pay cheque, whether they’re a house, stocks, ETFs, commodities or investment-linked savings plans, I’ve adopted the same principle as I did with my MtG card collection: I try to forecast their perceived value.

As you mature and age, you usually get less inclined to try new things. Let’s just say we all fall into our favourite ‘routines’ and figure out what works for each one of us. So, as a teenager, I was doing a lot of experimenting, which made sense at the time, because the future was way ahead of me. But well, times are different now. I’m older, with a family, with loans and bills to pay.

Which explains why, over the years, I’ve taken a greater interest in exchange-traded funds.

Sure, you may argue that hot stocks and gold are all the rave these days, but I’ve been there enough times to know anxiety and panic when I feel it. And as I’ve gotten older, with responsibilities that include not just myself as an individual, but my family and kids, I need to steer clear of FOMOs and crashes, and look towards steady money and growth.

By now, you’ve probably heard about Nikko Asset Management and its suite of exchange-traded funds. We already talked about it here and here.

The appeal behind Nikko AM’s two funds—the ABF Singapore Bond Index Fund and Nikko AM SGD Investment Grade Corporate Bond ETF—resonates with me on different levels. For starters, it comes with terms like “AAA-rated Government bonds”, “Investment-Grade” household names and “dollar-cost-averaging”.

RICE-pedia time:

AAA-rated: Also known as Triple-A (AAA), like when you score an A in Additional Mathematics and you go home and tell your mummy you scored a triple A. I’m kidding. A Triple-A bond rating is the highest rating bond agencies award to an investment, which means it has a lower risk of default and thus, is more creditworthy. Once again, less stress. Note that the AAA rating applies to the Singapore government bonds held by the ABF Singapore Bond Index.

Government bonds: I think it’s safe (sort of) to liken this to those grand movie finales where your sidekick (the government in this case) walks up to you after an intense shoot-out, puts a hand on your shoulder and says ‘I’ve got your back’. Once again, while it’s no guarantee, it’s always good to hear. Note that the Singapore government bonds are held under the ABF Singapore Bond Index.

Investment-Grade (IG) household names: This usually refers to the quality of a company’s credit. In financial speak, to be “investment-grade”, the company must be rated ‘BBB’ or higher by bond credit rating agencies like Standard and Poor or Moody. Anything rated ‘BB’ or lower is known as junk grade. So IG is a reflection of how probable the company is in repaying its debt. Note that when we’re referring to household names, we’re talking about companies like OCBC, NTUC, LTA, etc. in the Investment Grade Corporate Bond ETF.

Dollar-cost-averaging: DCA for short, it’s a strategy where investors divide up the total amount invested across periodic purchases of an asset to reduce volatility in the overall purchase. It’s like buying supplies at the supermarket. As prices fluctuate over time, you buy more when prices are lower (or discounted) and less when prices are high—the net effect is the average cost of your supplies is cheaper overall.

Through a regular savings plan, it’s as simple as parking as little as S$100 per month into each of them. Just like how I stash aside my checkered winter-wear in a remote portion of my cubby or know that my MtG cards are mint-cozy in their jacket sleeves, appreciating in value (and usefulness) when the time’s right, so it is with ETFs.

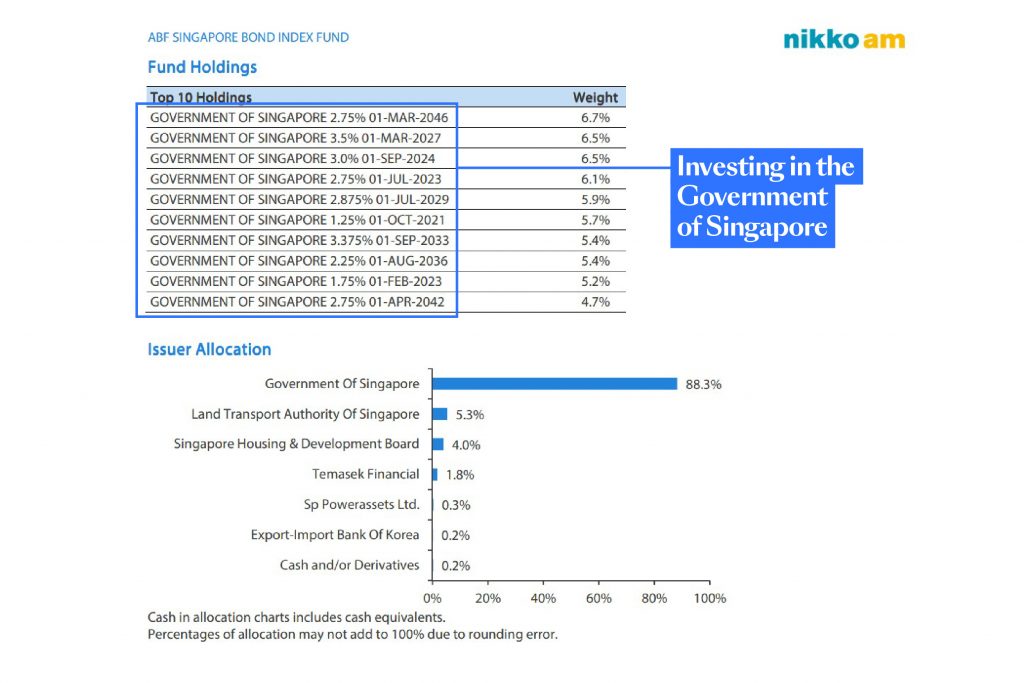

A majority of the ABF Singapore Bond Index Fund invests into the government of Singapore. The rest are made up by LTA, HDB, Temasek Financial, SP PowerAssets and so on. Even a layman can tell you that this fund is “quite solid”…

To put things in perspective, if you’re investing in the ABF Singapore Bond Index Fund, you’re hopeful that the government of Singapore will see things through. If you’re looking for diversification in assets, it’s a good step into government bonds as an asset class (other than your mandated CPF contributions of course).

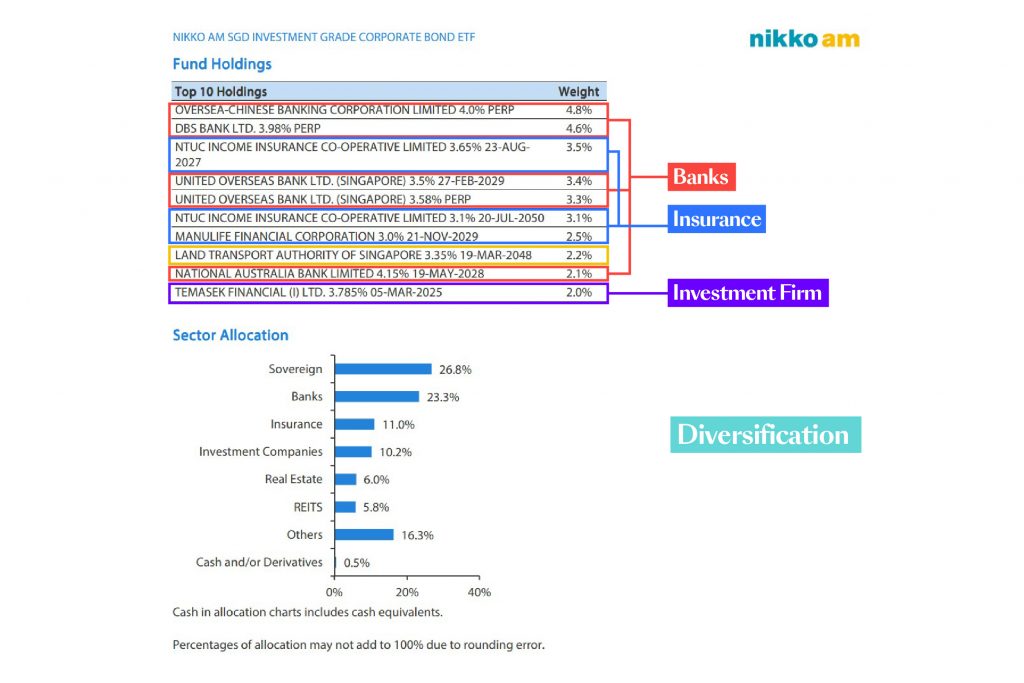

On the other hand, the Nikko AM SGD Investment Grade Corporate Bond ETF, slides a notch into government-linked, corporate finance territory. It counts finance corporations as its key holders. OCBC, DBS, UOB, NTUC Income Insurance, Manulife, National Australia Bank, Temasek Financial and LTA, you name them. (as of 31 August 2020)

When you look at its sector allocation, we’re talking a diverse spread across sovereign, banks, investment firms, insurance, real estate, REITS and others.

If you’re investing in this ETF, you’re spreading your risk across multiple sectors, but keeping them to traditionally higher performing ones. Despite what naysayers are saying about Covid-19 being a dampener of sorts, don’t forget what would happen when a vaccine is eventually found, everyone’s gunning to hit the ground running and the turnaround swoops us off our feet.

Trust me. It’s happened several times before. After the Asian and Global Financial Crises of 1997 and 2008-09 respectively, Singapore policymakers undertook unprecedented monetary and fiscal policy measures to stem an outflow of capital. These policies helped the city state bounce back faster and stronger than many other regional economies.

Which brings me back to my earlier example. If you’re going to invest in ETFs, and you want to diversify your S$200 or more a month at least, both ETFs are there to cover you along the spectrum between aversion and appetite.

Like I’ve said, it’s not just because these ETFs are simple to understand, or that their fees are much lower and they offer diversification, it’s also that just-in-case, when the weather turns, and the line on the chart suddenly swings. So it makes sense that when it comes to ETFs, both the ABF Singapore Bond Index Fund and the Nikko AM SGD Investment Grade Corporate Bond ETF keep that see-saw of risk balanced.

Like past crises we’ve seen since the Asian Financial Crisis in 1997, 9/11, SARS and the Global Financial Crisis, it’s always prudent to spread out our risks. The impact of the financial crisis affected primarily the housing and financial markets, 9/11 and SARS affected the travel and healthcare industries, and now, with Covid-19, we’re seeing impacts, and the need for critical changes, across industries.

And like any swinging pendulum, when every industry starts to find its footing and recovers, I hope to be on the right side of it … and you should too.

This article has been sponsored by Nikko Asset Management Asia Limited.

With its low- to medium-risk ETF offerings, such as the ABF Singapore Bond Index and SGD Investment Grade Corporate Bond ETFs, and its relatively higher-risk, potential higher return Singapore STI Index, Nikko Asset Management Asia has the right financial instrument you need to start your investment journey.

Disclaimer

The views and opinions expressed in this article are those of the author and do not necessarily reflect the position of Nikko Asset Management Asia Limited (“Nikko AM Asia”).

The Central Provident Fund (“CPF”) Ordinary Account (“OA”) interest rate is the legislated minimum 2.5% per annum, or the 3-month average of major local banks’ interest rates, whichever is higher, reviewed quarterly. The interest rate for Special Account (“SA”) is currently 4% per annum or the 12-month average yield of 10-year Singapore Government Securities plus 1%, whichever is higher, reviewed quarterly. Only monies in excess of $20,000 in OA and $40,000 in SA can be invested under the CPF Investment Scheme (“CPFIS”). Please refer to the website of the CPF Board for further information. Investors should note that the applicable interest rates for the CPF accounts and the terms of CPFIS may be varied by the CPF Board from time to time.

The performance of the ETF’s price on the Singapore Exchange Securities Trading Limited (“SGX-ST”) may be different from the net asset value per unit of the ETF. The ETF may also be delisted from the SGX-ST. Transaction in units of the ETF will result in brokerage commissions. Listing of the units does not guarantee a liquid market for the units. Units of the ETF may be bought or sold throughout trading hours of the SGX-ST through any brokerage account. Investors should note that the ETF differs from a typical unit trust and units may only be created or redeemed directly by a participating dealer in large creation or redemption units. Investors may only redeem the units with Nikko AM Asia under certain specified conditions.

This document is purely for informational purposes only with no consideration given to the specific investment objective, financial situation and particular needs of any specific person. It should not be relied upon as financial advice. Any securities mentioned herein are for illustration purposes only and should not be construed as a recommendation for investment. You should seek advice from a financial adviser before making any investment. In the event that you choose not to do so, you should consider whether the investment selected is suitable for you. Investments in funds are not deposits in, obligations of, or guaranteed or insured by Nikko Asset Management Asia Limited (“Nikko AM Asia”).

Past performance or any prediction, projection or forecast is not indicative of future performance. The Fund or any underlying fund may use or invest in financial derivative instruments. The value of units and income from them may fall or rise. Investments in the Fund are subject to investment risks, including the possible loss of principal amount invested. You should read the relevant prospectus (including the risk warnings) and product highlights sheet of the Fund, which are available and may be obtained from appointed distributors of Nikko AM Asia or our website (www.nikkoam.com.sg) before deciding whether to invest in the Fund.

The information contained herein may not be copied, reproduced or redistributed without the express consent of Nikko AM Asia. While reasonable care has been taken to ensure the accuracy of the information as at the date of publication, Nikko AM Asia does not give any warranty or representation, either express or implied, and expressly disclaims liability for any errors or omissions. Information may be subject to change without notice. Nikko AM Asia accepts no liability for any loss, indirect or consequential damages, arising from any use of or reliance on this document. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Nikko Asset Management Asia Limited. Registration Number 198202562H