While he sports a luxury watch that I could only ever afford if I built it on Minecraft, I still own the same black, $30 Casio I bought for NS.

That Casio is not a testament to my frugality. Rather, it is the embodiment of how irresponsible I am with my money. I’ve had my eye on a Seiko automatic for a while now, but somehow, even after drawing a salary of $3000 a month for almost a year, I never seem to have enough money left at the end of the month to make that purchase.

“You’re too bloody irresponsible,” Lance often scoffs.

Sometimes, he would add, “If you can’t take control of your finances, maybe I should do it for you.”

I used to laugh at this; I never believed it would actually happen. We all have our demons, and never having savings is simply my cross to bear.

But last week, after yet again failing to save enough, something snapped.

“Enough is enough”, Lance sighed. And with that, he removed my debit card from my wallet, and told me he was going to take charge of my salary for the next month.

2 seconds later, breaking into a grin, he said, “We’re going to have some fun with this.”

After deducting monthly essentials like insurance, transport, bills and my parents’ allowance, I’m usually left with about $1,200 for all outstanding expenses, which is 50% of my salary. Of course, many people survive on less, but I eat much more than the average man.

And so during each of the next four weeks, I would be given $300 to spend. While that might seem like a lot for an entire week, it includes outings that I have with friends, during which I tend to spend more.

A special condition would also come into effect, with each condition meant to target one of my most needless spending habits. If I were to break any of them, I would I get $100 dollars less for the week after.

I survived on a dollar a day in primary school. This should be easy, right?

Budget: $300

Remaining Funds: $900

“Look, you’re going to save a tidy amount from not ordering meat. Do you know that the richest people on Earth are vegetarians?” Lance claimed, although I had my doubts.

“Plus, you get to lose those love handles that’re just collecting dust anyway.”

He was clearly enjoying this a little too much, and I did not want to give him the satisfaction of me failing the challenge. I mean, how difficult could it be?

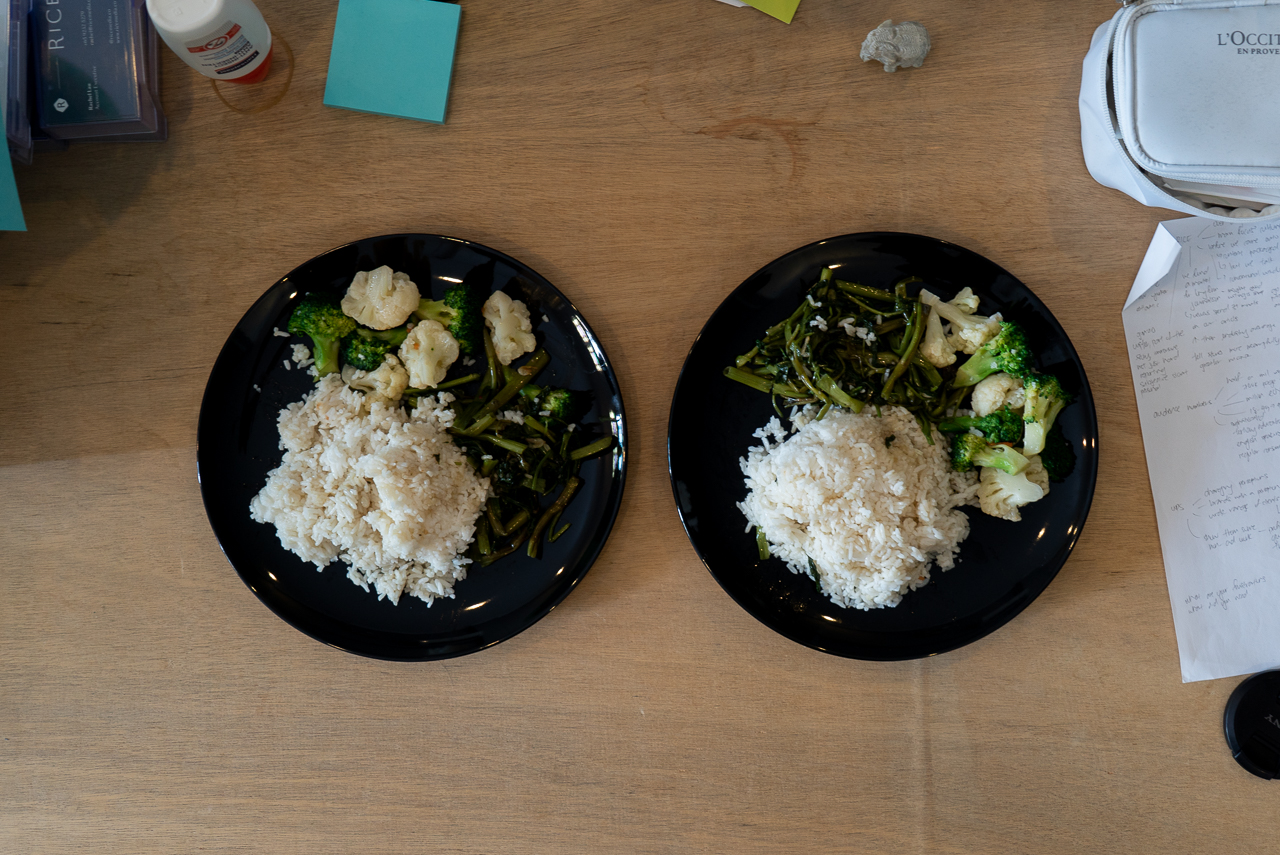

On the first day, I ordered a medley of vegetables with some rice. If you could eat an episode of “Keeping Up With The Kardashians”, this is exactly what it would taste like.

Needless to say, I was unsatisfied, and went to bed a very hungry and angry man.

Nevertheless, I knuckled down and repeated this painful ordeal for the next few days.

Eventually, the nostalgia got too much, and I caved by ordering a popiah to go with my Nasi Padang. I texted Lance to inform him of my failure, to which he replied, “:)”.

His cockiness got to me, and I knew I had to do my utmost best to complete the next week’s challenge, whatever it was.

For motivation, I went to KFC on the final day of the week and ordered a three-piece meal.

Budget: $200 ($100 penalty for failing previous challenge)

Remaining Funds: $700

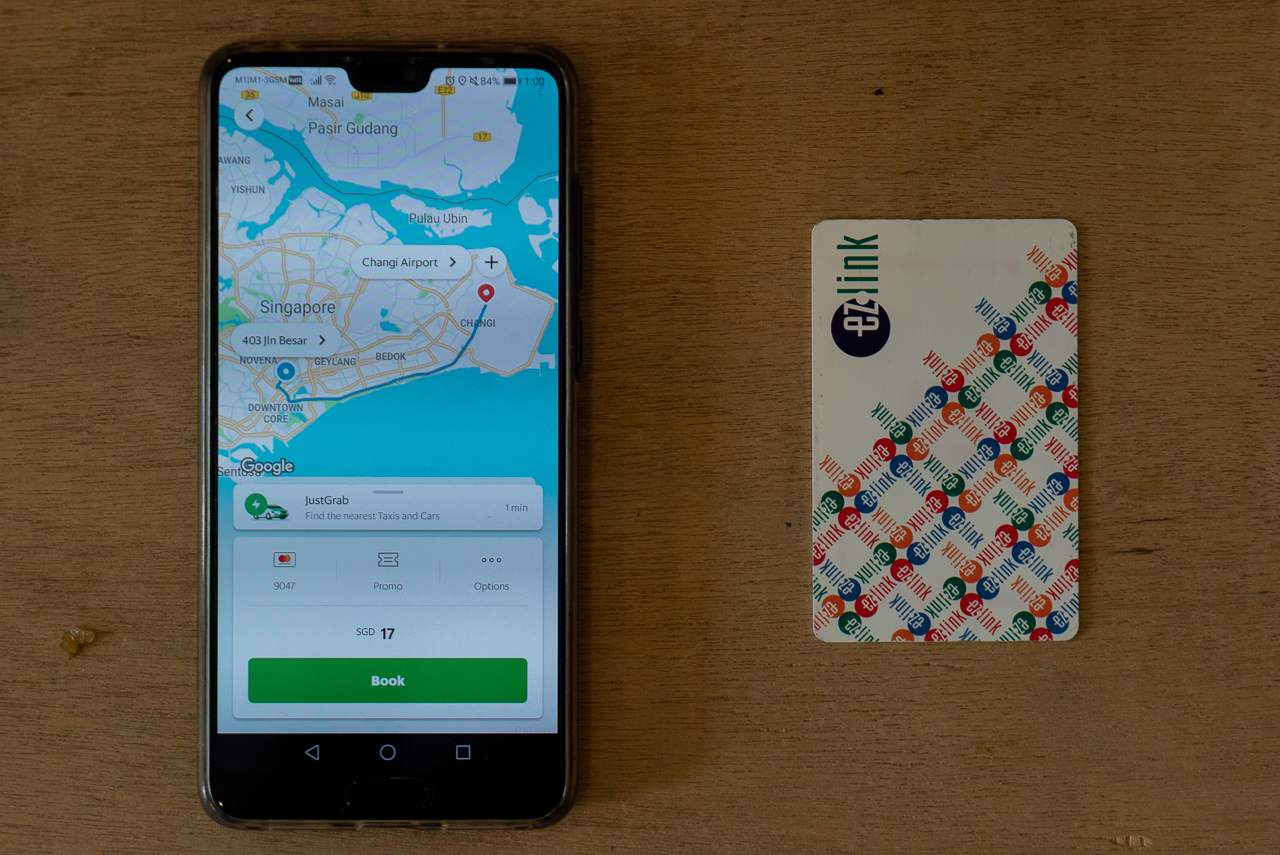

Like many of you irresponsible millennials reading this, I too cannot wake up at 7 AM, read the newspaper, take a long shit, have my morning coffee, and finally get to work on time. Hence, the only reason why I am still gainfully employed is because Grab exists.

Not the best start to the second week, but I decided to just be late. I might get reprimanded, but at least I wouldn’t have to suffer Lance’s smug expression.

The next day, forcing myself to get up earlier to prepare for work made me feel, for the first time, as though I had full control of myself. I was not putting myself at the mercy of the punctuality of buses during peak traffic, and it felt incredible.

On the fourth night, I went out for some drinks with friends and barely caught the last train. I was proud of myself, but the heavy night of drinking resulted in a hangover that made waking up the next morning a monumental task. I woke up an hour late, and booked a Grab to work.

I had failed myself. Again, Lance was going to lord it over me, and I would only have $200 again for the next week.

That morning, just as I thought things couldn’t get any worse, I heard a beep as the Grab Car glided along the expressway.

“Boy ah, later got additional charge for ERP hor,” the driver proceeded to growl.

FML.

Budget: $200 ($100 penalty for failing previous challenge)

Remaining Funds: $500

Usually, at the start of a long day at work, I like to prime myself to write the best I can by beginning with coffee at the neighbourhood cafe. When the day ends, I wind down by grabbing a beer from either the kopitiam or a nearby pub. There are those who say that alcohol is liquid courage. For me, it is liquid sanity. Without it, I am but a shambles of a human being.

But guess what? I pulled it off.

I might have had several migraines from the lack of caffeine, and I even ended up taking several naps at work. But I was glad that the tides were turning, and that I finally had a win under my belt.

Lance even gave me a call when the week ended.

“I’m so proud of you Shaun,” he said, “The past two weeks were tough, but you managed to pull through. It’s nice to see some growth, isn’t it?”

“As a reward for completing the challenge, the $200 I took away from the first two weeks will be handed over next week. It should make next week’s challenge easier. You deserve it.”

Oh, what a fool I was for believing him.

Budget: $500

Remaining Funds: $0

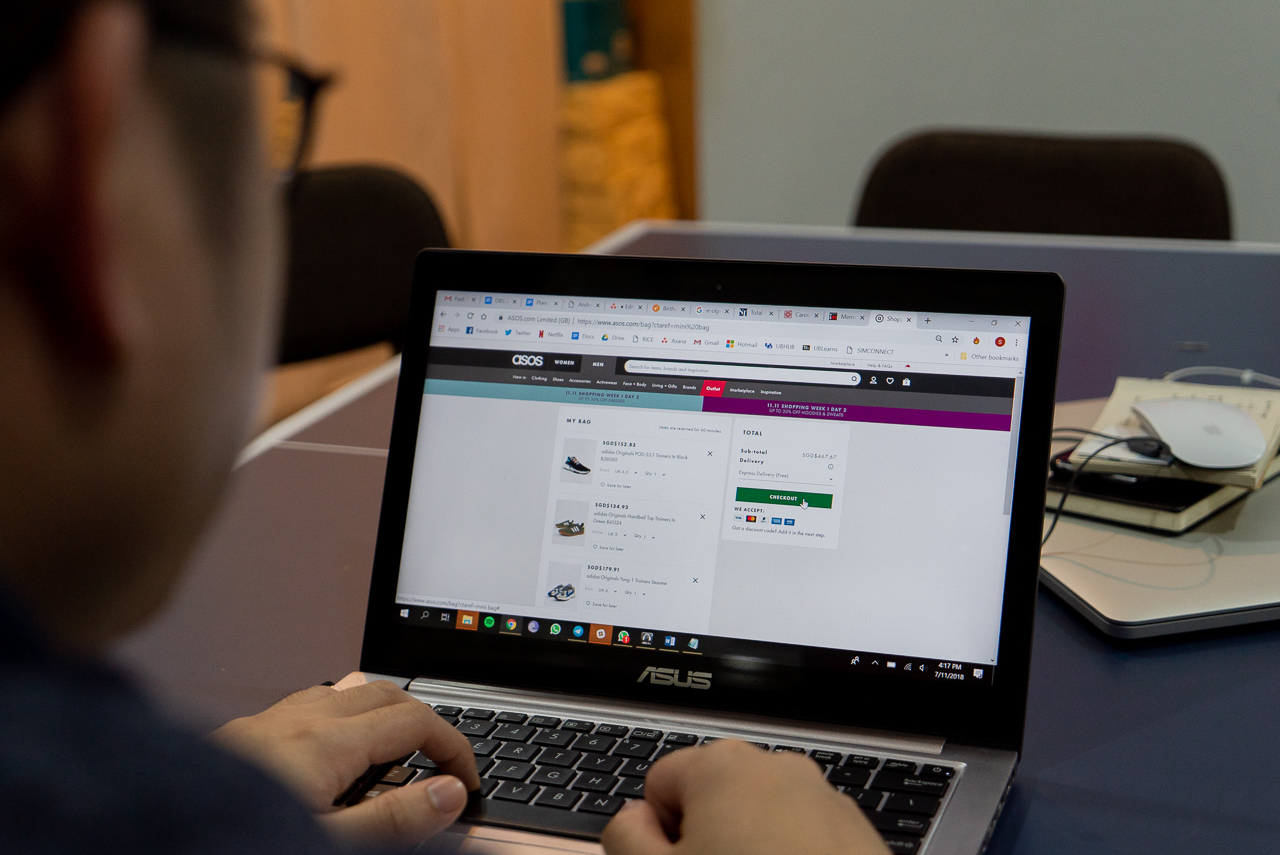

This is also usually when my inhibitions start to loosen. Normally, I don’t have that much money to spend at the end of the month. Yet due to Lance’s “generosity”, I now had $500 for the week, and I could indulge in anything under the sun, except for online shopping.

You sick, sick man.

Over the past year, I had bought over 10 pairs of sneakers through online sales, and it had become an itch I had to scratch. Against the advice of my financial advisor, I constantly looked for more deals to capitalise on. Back then, I thought that whatever money I had saved would mean more funds to spend on shoes. I could not have been more wrong.

Yet strangely, as I scrolled through page upon page of shoes, I was not tempted to checkout the three pairs in my shopping cart. Perhaps it was the image of Lance smirking to himself that drove me to restraint; it gave me strength just knowing how much he’d love that I wouldn’t be able to spend all that money.

All the same, I chose to believe that it was my newly-developed thriftiness.

In no time at all, seven days passed, and I overcame the final challenge.

Challenge Breakdown:

Week 1 Budget: $300

Remainder: $83

Week 2 Budget: $200

Remainder: $35

Week 3 Budget: $200

Remainder: $23

Week 4 Budget: $500

Remainder: $282

Total Saved: $423

While I failed two of the challenges and struggled with the rest, I had also come to appreciate the virtues of being thrifty. I felt free of my impulses, and the assurance I got from having reserves in my bank account was more valuable than any big-ticket item that I could have bought with that money.

But of course, not everyone has to resort to such drastic measures to save money. You do not have to cut yourself off in every area just to save. While it’s important to build up a reserve, we need to strike a balance between that and indulging ourselves once in awhile, just to keep our sanity.

Then, after Lance paid for dinner (I made sure he did), he handed me a small paper bag with the word “Seiko” printed on it. As much as he was an ass, I always knew that Lance could be a great friend.

After counting my blessings, I looked into the paper bag, only to find that instead of a Seiko watch, it was a copy of “Minecraft”.

“Now build yourself a watch, nerd!” he cackled, nearly falling out of his chair.

What an idiot.