Living in Singapore is expensive.

The cost of education is increasing. The Goods and Services Tax (GST) is continually going up. Public transport fare hikes have made getting around more expensive than ever. Car? Sorry, can’t afford it.

The money crunch gets worse as you get older. As I approach my 29th year, thoughts of settling down have inevitably started creeping in, thanks in no small part to the many friends who are “putting a ring on it”.

How they can even afford that ring though, is a mystery I’ve yet to figure out. In between my current daily expenses, setting aside a fixed sum to give to my parents, and saving for a future house, being able to afford a modest 4-figure diamond engagement ring has become more a dream than reality.

Lately, I’m beginning to wonder if it’s really necessary to be spending so much on a diamond ring in the first place. What are we really paying for and is it worth it?

To get to the bottom of the issue, I went to see the one person who knows the most about valuing such items: a pawnbroker. And for good measure, I reached out to a company called LUXIEE to ask for a few rings to bring along for comparison. They were game enough to agree.

According to my colleague, Shaun, this was a man who would not only teach me a thing or two about gold, but also explain how he values an item in the first place, thanks to the experience gained from decades in the pawnbroking business.

As soon as I introduce myself, the 76-year-old fires a number of questions my way from behind steel bars—all of which have nothing to do with pawning or money.

“Have you had breakfast?”

“Do you want a bottle of water?”

“Lai [come], sit. Sit.”

It feels like I’ve stepped into my grandfather’s house instead of a seedy pawnshop Singaporeans commonly associate with financial difficulty or bankruptcy. Uncle Lam entered the pawnbroking business close to 60 years ago when he was just 15 or 16. At the behest of his father who was in the industry, he joined the family business and began working in a pawnshop owned by a relative.

“My relatives taught me the basics but most of what I know, I learnt myself. It was a process that took years and years. But the best teacher has been experience,” Uncle Lam says in mandarin, a broad smile deepening the creases in his face.

Decades of “training” taught him how to spot a fake Rolex from a mile away. He’s also able to gauge the weight of a piece of gold simply from holding it.

Oh, and when it comes to assessing diamonds? The Gemological Institute of America (GIA) certificate (a grading report issued that’s regarded by jewellers around the globe as the premier credential of a diamond’s quality and authenticity) is nothing more than complementary reading to him—useful, but not strictly necessary.

“Experience allows you to do that. You learn how to go by instinct and rely on gan jue [feeling] when appraising an item.”

As impressive as Uncle Lam’s abilities sound, there’s no running away from the fact that he is still a pawnbroker. Which means one thing: just because he can tell how much something is worth, it doesn’t mean that’s the price he’s going to give you for it.

I ask whether it’s true that pawnbrokers only give 60-80% of the market value of the pledge. Before I can even finish my sentence, Uncle Lam interjects.

“No,” he says with a smile, “we as pawnbrokers, and pawnshops, in general, aren’t designed to rip you off.”

For better or worse, the pawnbroking industry has become a lot more competitive in recent years. Where once there were only humble neighbourhood pawnshops, big names such as MoneyMax, ValueMax, and Maxi-Cash have entered the fray.

This, in turn, means every pawnbroker knows that their valuations have to be competitive yet realistic. They can’t just give customers the lowest possible price for fear of losing their business. After all, if someone else is willing to offer $100 for my item, why would I be satisfied with your $95?

Also, when it comes to appraising your pledge, the emotional attachment/sentimental value you place on the item you’re pawning means little—if anything—to a pawnbroker.

The only thing other than the item’s intrinsic value which can determine its price?

“Brand.”

The objective was simple. LUXIEE claims to be the world’s first and only diamond marketplace that connects consumers directly with suppliers. Because their business model cuts out the middlemen, their prices are therefore significantly reduced. But at the same time, how does their quality hold up?

Not knowing what to expect, I hand the rings over to Uncle Lam. As he uses a specialised diamond gauge and an eye loupe, the seconds of complete silence stretch into minutes.

Eventually, Uncle Lam gives me his verdict.

To him, the first diamond is worth $1,000. The second, $1,500. He was willing to offer me and at best, $600 for the third. Not knowing if the valuations were good or bad, and how he arrived at the figures, I ask Uncle Lam if he could explain his appraisal process to me.

Fair warning: the next bit gets a little technical.

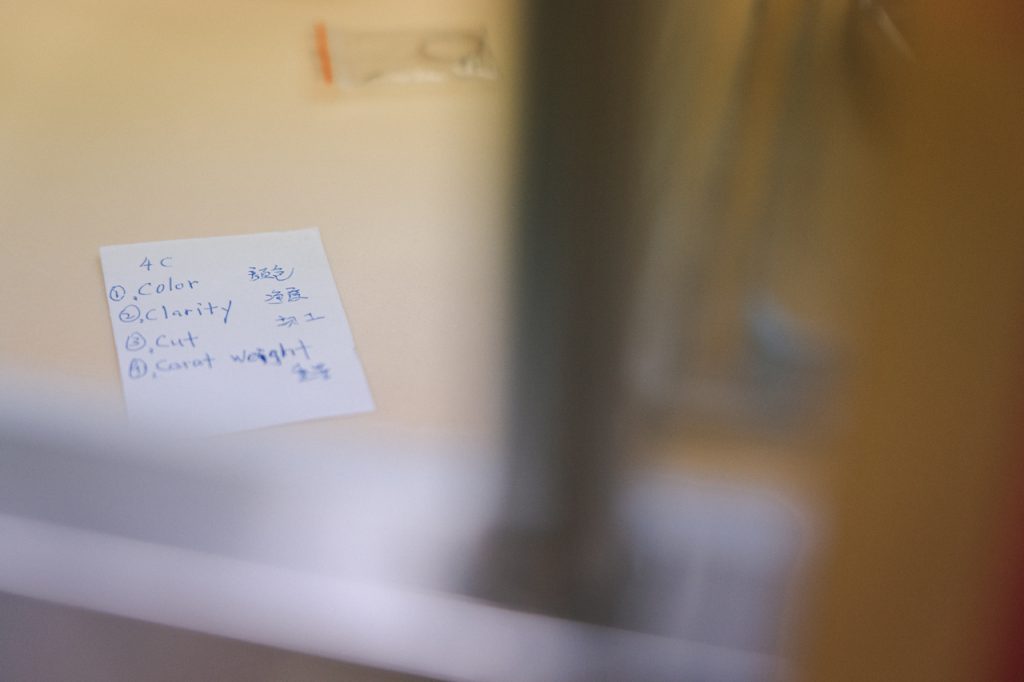

A diamond’s “4Cs” stand for carat, colour, clarity, and cut. As you would expect, each one examines a different element of the diamond, and all of them contribute to its monetary value.

But simply knowing what the 4Cs stand for isn’t enough. You also have to understand how they’re measured.

A diamond’s “colour” actually refers to the absence of colour. Lest you forget, diamonds are naturally occurring minerals formed in and mined from the depths of the earth. The whiter the stone, the more desirable and therefore pricier it is. Colour is graded on a scale of D–Z, with ‘D’ being the most colourless and ‘Z’ having a light but obvious yellowish tinge. Differences in grades near each other (D-E, E-F) are very slight and invisible to the naked eye, but nevertheless, impact the overall quality and price of the diamond. It’s also worth noting that unless 2 diamonds are of two opposite ends of the grading scale, the distinctions are so subtle that they are invisible to the naked or untrained eye. But these distinctions make a very big difference in diamond quality and price.

“Clarity” measures the amount, size, and placement of internal ‘inclusions,’ (small imperfections in the stone that are the result of the diamond’s natural formation in the earth’s crust) and external ‘blemishes’ (flaws on the stone because of how it was cut and/or polished). Similar to how colour is measured, clarity is graded from ‘Flawless’( virtually no imperfections), to ‘Included,’ which contain a significant number of imperfections. ‘VVS 1 or VVS 2 (Very Very Slightly included) means that the inclusions are so slight that they’re difficult for even a skilled grader to see under 10x magnification. In determining diamond clarity, the number, size, relief, nature, and position of these inclusions/imperfections are assessed, together with how they affect the overall appearance of the stone. No diamond is perfectly pure, but the closer it is to being perfectly flawless, the higher its value.

“Cut” refers to the proportion and arrangement of the diamond’s facets and the quality of workmanship. The everlasting appeal of a diamond besides its symbolism of romantic love, is how it interacts with the light. This means that a well-cut diamond sparkles brighter than one that isn’t because light is reflected better back to your eye when you look at the rock on your finger. Think of it as shining a bright light in a carnival’s house of mirrors. The more symmetrical and aligned those faces are cut, the more dazzling your bling.

Finally, “Carat” refers to the diamond’s weight. Generally speaking, the higher the carat weight, the more expensive the stone. However, two diamonds of equal carat weight can have very different quality and price when the other 3 Cs are taken into account.

Uncle Lam explains that the $500 gap in price between the first two diamonds is due to their colour.

“This diamond is better than the first one. Everything else is the same but the second one is more colourless. It’s whiter. Probably about a grade difference.”

Remember: even if the rock is huge, if it’s cut badly or the colour is off, it’s still not going to be worth very much. Or at least, should not be—provided you know what to look for and how to examine the stone you’re going to buy.

The third diamond falls in the lowest price bracket because it’s no bigger than 0.3 carats, according to Uncle Lam’s trained eye. This means that despite it having even better clarity than the first two diamonds, it’s only worth a fraction of its bigger brothers.

Here’s a table of all the information to help you understand what I mean:

| Diamond | Carat Weight (ct) | Colour | Clarity | Cut | Uncle Lam’s Valuation ($) | LUXIEE’s Price($) | Depreciation (%) | Other jewellers’ retail price ($) | Depreciation (%) |

| 1 | 0.6 | E | VVS2 | Excellent | 1,000 | 2,403 | 58.39 | ~4,000 | 75 |

| 2 | 0.6 | F | VVS2 | Excellent | 1,500 | 2,503 | 40.07 | ~6,200 | 75.81 |

| 3 | 0.31 | G | VVS1 | Excellent | 600 | 602 | 0.33 | 950 – 1,100 | 41.46 |

But why do brands matter?

Brand names matter to pawnshop owners for one main reason: assured quality. An internationally famous, high-end luxury brand like Cartier has an image to protect and a reputation to uphold. They would rather die than have their products associated with shoddy craftsmanship. As such, they ensure every diamond they sell meets a minimum standard. The diamond’s quality will be good. Whether it’s worth the price they slap on it is a different matter.

That said, the actual differences in the diamond are very, very marginal the higher up the price range you go. The naked eye cannot spot the differences.

“No matter how strong the brand is, if the quality is no good, we won’t give a good price. We base our judgment on purity—that’s still the most important thing. The price we offer for a “branded” diamond will be higher because the diamonds they sell are specially chosen “selected items”. The price it can fetch on the open market is also more. So yes, we’ll offer you a better price. Not by very much, but I cannot say that it’s not there.”

Long story short, the bulk of your money goes towards the prestige of the brand name rather than the actual quality of the product you’re buying. Which I guess would be more acceptable if you’re paying tens (not thousands!) of dollars for something you probably have no clue about, and others can’t/won’t be able to appreciate either.

I mean, who walks around with diamond inspection tools anyway?

So … what does this mean?

Put simply, Uncle Lam was right on the money in terms of the diamonds’ attributes. His valuations weren’t that far off either. On average, he offered about half of what LUXIEE’ did, with his appraisal of the 3rd diamond coming the closest.

It’s expected, since pawnshops won’t offer you retail price. After all, by the time an item gets to them, it’s already “second-hand” or at least perceived to be as such. Depreciation begins the second you carry the diamond out of the store.

However. If you compare Uncle Lam’s valuations with the retail price of diamonds with similar attributes from well-known, local jewellery shops, you’re in for a rude awakening.

Just look at the startling discrepancy in prices and depreciation. All for a shiny piece of rock dug out of the ground.

The truth is that once you cross a certain threshold, there’s simply no justifying the amount you’re going to spend. I mean, why would you go to a luxury boutique and fork out 3 months of your pay—incidentally, the biggest and most successful marketing ploy in the history of mankind—when you can get the exact same thing for a price your bank account will thank you for?

As much of our income stagnates and cost of living continues to increase, it’s only normal that many of us now have different priorities.

Let’s be real for a second. You’re probably not going to wave your finger at everyone you meet before launching into a lecture on why your bling is so expensive and therefore the best. And you’re definitely not going to carry scopes around so your friends will know what you’re on about.

So don’t be a brand whore, spending an exorbitant amount of cash on a logo or name. Instead, save the money for a nice honeymoon. Or spend the cash on renovations for your BTO flat. Because do I now know better than to judge the value of an item based on its brand and price alone?

In the words of anyone who’s ever been presented with a diamond ring: I do.

Want to put a ring on us? Get in touch: community@ricemedia.co