I first meet Marcus and Tiffanie near Queenstown MRT as we head towards their future BTO neighbourhood. At first glance, the newly-weds seem to have it all.

My first impression? A power couple. After all, they’re on their way to comfortably ticking off all the boxes of the Singapore dream. A steady income? Check. Marriage? Check. BTO? Check.

Yet while all this might be true, the couple also admits to having done little to no planning when it comes to their shared retirement. They might have ticked all the above boxes early, but they still feel unprepared for their future. This has been largely due to the lack of discussion and personal knowledge surrounding the topic.

“We had no income, so just eat at Koufu or Kopitiam lor,” shares Marcus.

Today, both parties enjoy a stable, above-average income. Marcus works in the banking industry under the IT department, while Tiffanie is in financial sales.

As much as possible, they try to cap their spending each month, saving at least half of their monthly salary. They also place small funds in various different joint accounts for investment purposes. The question though, is whether these plans are sufficient.

“We might have placed some money everywhere, but we don’t really know what they do,” admits Tiffanie.

When asked about their thoughts on retirement, they echo a similar sentiment: “Like many people, we both know that retirement planning is important. It’s definitely a concern in our heads, but we never know where and how to start.”

Their situation isn’t the exception. A recent financial wellness survey revealed that most Singaporeans are still neither equipped for financial emergencies nor well-prepared for retirement. In another study, it was found that 69% of Singaporeans felt that they would not be able to retire comfortably.

As such, young couples should recognise the importance of having discussions about retirement sooner rather than later. By identifying goals at an earlier stage, they can then start making plans and work together towards them.

For now, the couple foresees themselves having children before Tiffanie reaches 30 years old—which gives them 5 years to save up.

“It’s a bit tight if we have children now. We want to work hard and bulk up our savings first,” they tell me.

Exciting as this may sound, it also comes with a ton of uncertainty.

The Importance of Emergency Funds

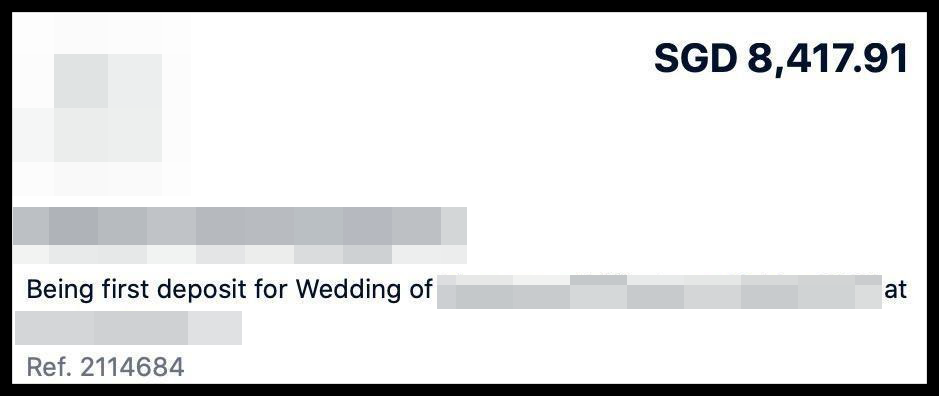

Settling down, in reality, hasn’t been entirely a smooth-sailing process. Since Marcus was the first of the two to step into the workforce, the initial down payment for their house easily wiped out most of his CPF savings.

The majority of us don’t often see life beyond the next 5 years, what more life in our 60s and 70s? And while it’s possible to chart a course towards your retirement dream, we aren’t always aware of the options.

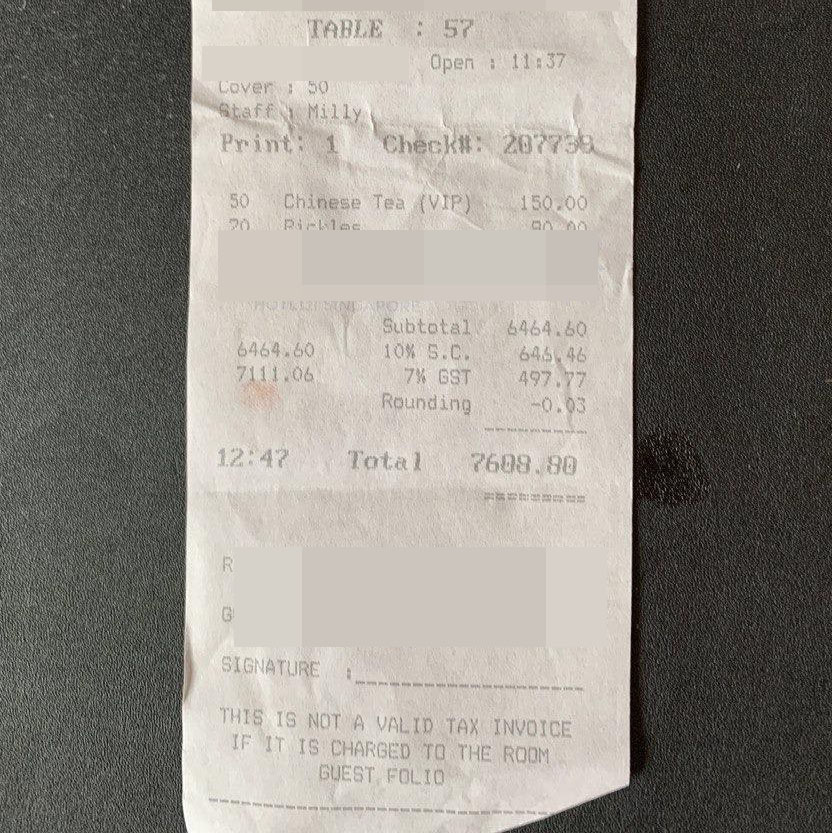

An additional event, however, also means additional costs. This strain becomes apparent when they explain the situation to me.

Like many of us, anxieties surrounding financial and job security are still undeniably present. This worry has also heightened due to Covid-19, with Marcus already witnessing the departure of some colleagues.

When asked to imagine a scenario where they were to lose their jobs, both Marcus and Tiffanie turned to look at one another, before looking back at me, confusion and bewilderment flashing across their faces. I knew then, that this is not even an option.

Save on Taxes, Build a Nest of Savings

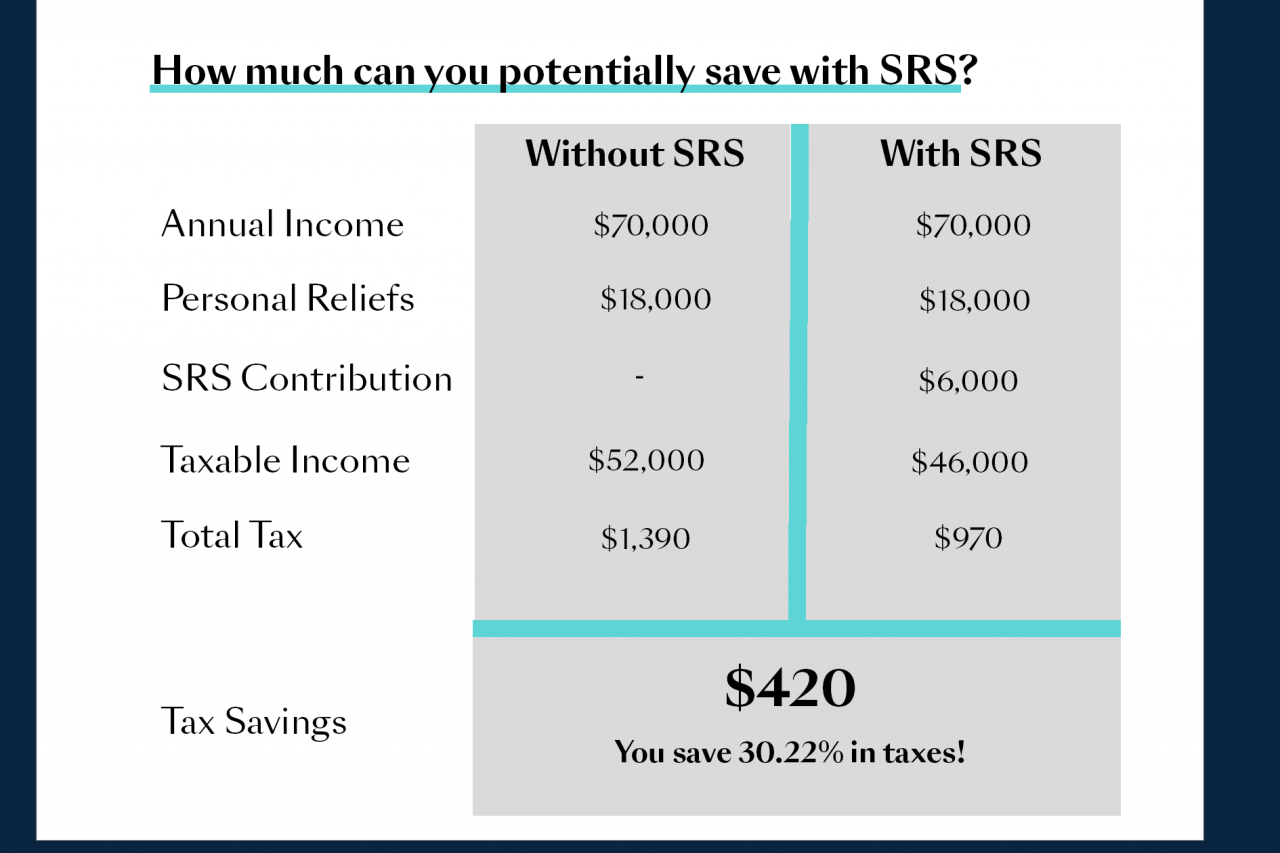

When we were on the topic of retirement planning, I brought up the Supplementary Retirement Scheme (SRS) to Marcus and Tiffanie. The SRS is a voluntary scheme that aims to help people save for retirement. It sounded familiar to them, but they were still relatively unsure of its benefits, especially on how it helps to reduce taxes.

Using a calculator, we worked together to see how useful it would be.

With an SRS contribution each month, the couple can also have peace of mind knowing that there will always be a sum of money set aside for them until retirement. Ever left a pair of jeans someplace and later found cash in one of its pockets? The best kind of money is often the kind you forgot you had, and discovered again by accident. Of course, one has to first be willing to part with a sum of money each year until retirement age.

Even though contributions into an SRS account provide tax savings, it only earns 0.05% interest per annum. As such, one can consider investing their contributions in a wide range of financial assets, including those offered by financial institutions.

A plan that the couple can consider is AIA Smart Wealth Builder, which is an endowment insurance plan that makes their money work harder to magnify returns through a combination of guaranteed cash value and non-guaranteed returns. Moreover, regardless how the market performs, the premium paid will be fully secured from the end of the 15th policy year.

Alternatively, AIA Retirement Saver (III) provides guaranteed monthly income over a period of 15 years.

At the end of the day, these are plans that help to provide a sense of relief by taking away some unspoken pressures that many have when it comes to their retirement.

For Marcus and Tiffanie, their only hope for retirement is to be financially stable.

“When we’re old, all we want to do is chill,” they tell me.

I’ve learned that fantasising about early retirement is not the same as being realistic. If we want to be cool grandparents who travel around the world while still at the peak of our health, then we have to first ensure that some sort of retirement planning is in place. Otherwise, it will remain a dream.

Eventually, our initial awkward encounter transforms into a rant session, as we sit in the food court bonding over our uncertain futures. Clearly, anxieties surrounding retirement life is something that we can all identify and empathise with.

While I may not have the ability to make active contributions to my SRS account just yet, it’s a different story for them. Like what Marcus and Tiffanie shared with me during the end of our meeting, at least it is an option now.

Retirement may not demand our immediate attention, but it’s still a looming prospect. It’s scary, but it doesn’t have to be.

If you haven’t already, follow RICE on Instagram, Spotify, Facebook, and Telegram.

If you have a lead for a story, feedback on our work, or just want to say hi, you can also email us at community@ricemedia.co.