Most of us dream about ditching our day jobs. Some of us even dream of doing it decades before turning 62.

This can be partly attributed to our nation’s obsession with chasing productivity. Growing up, we’ve been led to believe that the rat race is for life, and we can rest when we finally retire—whenever that may be. We silently accept this workaholic culture as a core Singaporean truth, and escaping can seem tough; almost impossible.

Turns out, it’s possible to live life on your own terms. Sometimes, as these 3 individuals show us, it boils down to making a plan and executing it.

Loh Chang Kuan, 58, worked for Singapore Airlines. He retired early in November last year.

I didn’t set a hard date, because I knew I wouldn’t be able to afford retiring at 50 and still sustain the lifestyle I was accustomed to. But the thought stayed with me ever since, and at my age—I’m now 58—I think it’s finally time. Now, after 32 years with Singapore Airlines, I am in early retirement.

I want to do the things I want to do while my body is still able to do them. The question is: how many good years do I have left?

In my case, it does make a difference that I had a stable job and no kids. There were a few things I did to prepare, like buy health insurance, and I also topped up my CPF Retirement Account to the maximum amount (the Enhanced Retirement Sum) when I turned 55. I’d already accumulated a decent amount in my CPF, but topping up was a low-effort way to ensure I get higher CPF payouts in future, as these savings will continue to earn interest and grow till I start receiving a lifelong retirement income under CPF LIFE from 65 years old.

But to be honest, it wasn’t until a couple of years ago that I seriously began looking at my finances. Now that I know how much it helps to plan ahead, I wish I’d gotten started much earlier.

I’m lucky that I’ve managed to pull things together, but it would’ve been better if I had a longer runway—my CPF funds would have earned even more interest, for example.

If I can, when we’re able to travel again, I’d like to do 2 to 3 long holidays of 2 to 3 weeks each, every year. For example, there are the Peace Boats from Japan: they sail around the world for about three months, doing missions for social and environmental causes. A friend and I have been talking about it and we’d love to go. Another friend just bought a place in Tuscany, and is planning to turn it into an AirBnB-style outfit with a restaurant.

I know I can’t keep up that kind of lifestyle forever, but it was important to me that I do these things while I still can. Given that I’m retiring early, I have to be financially independent. That was another reason why I took the step of topping up my CPF— so that I can receive higher CPF LIFE payouts to supplement my retirement income beyond age 65. These lifelong payouts would ensure that I do not need to worry about running out of retirement savings and also provide an ‘allowance’ for my future travels. I am looking forward to sustaining my current lifestyle in my golden years.

My last day of work was on 30 November. For now, I don’t intend to do anything remotely resembling work for at least two years.

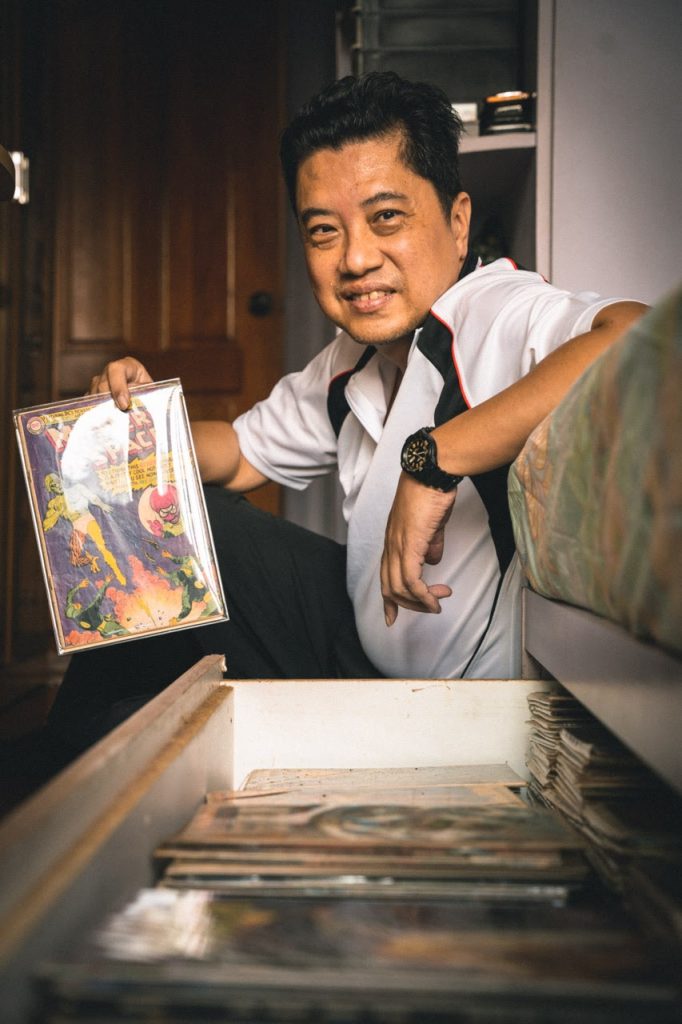

Ronald Hee, 56, is a freelance writer. He retired early, at 44.

If you’re wondering how I had the time to write a book, it’s because I’d retired by then.

Getting out early was always part of the plan. 44 was a little earlier than expected, but it seemed like a good time. It’s now been 12 years since I left full-time work.

Part of it was that I felt like I had enough and no longer needed to be a rat in the rat race. The other catalyst was that my dad passed away, and looking back at his life made me think: there are so many other things you can do in life besides wake up, go to work, come home, watch TV, sleep, rinse, repeat.

There’s no need to be locked in the 8-to-6 cage. I’m free to do projects outside this. I get to be a master of my own fate.

Because I left full-time work early, I knew I’d have a longer retirement runway than most people, so I rely on a few other sources of income to sustain me. I still take on paid projects here and there, and continue to draw income from my own private investments on the side.

You can’t get around that, but you don’t have to go to extremes like the Financial Independence, Retire Early (FIRE) movement. The main thing is to start early. And in terms of what you save, compound interest will work its magic, so when you hit your 50s, you start reaping the benefits.

CPF helps, too. I’ve set aside a sum of CPF savings early and this has served as the foundation of my retirement plan. The interest rates are good, so my CPF savings grow over time and it has helped me to accumulate a bigger retirement nest egg as years passed.

I need not worry about having enough to meet my retirement needs, knowing that my CPF savings will provide me with lifelong monthly payouts when I join CPF LIFE. With the steady stream of retirement income from age 65, I can be assured of a comfortable lifestyle in my golden years, even as I age and stop work completely.

In my younger days, back when I was in my 30s, I began to channel a portion of my income into investments. I invested some of my CPF savings as well. This was a way to help grow my nest egg further. They’ve done well, and if I could turn back time, I’d probably have invested even more. Having said that, any investment of CPF savings should be considered only after due research, or when one is confident enough to know that it will yield more than the interest earned by our CPF savings.

Things are a bit tricky now because of COVID, but I take on mainly writing projects. I’ve also done a few TV and video projects, both behind and in front of the camera. But the main thing is that I can do these for fun, rather than based on what they add to my bank account.

Right now, I’m a bit mang zang (restless), because there haven’t been many projects, no thanks to COVID, and I can’t travel. But the main thing is that I get to set my own pace. When you’re working 9-5, you’re just focused on the task at hand, the day ahead; you might not see an end, or the bigger picture.

If I hadn’t made the effort to take charge of my finances early on, I wouldn’t have been able to leave when I did. Having a secure financial foundation meant I could afford to take that leap.

And once I’d done it, I didn’t want to go back.

I mean, when you die, are you going to say, ‘I wish I’d handed in that report on time’? Or will you think, I wish I’d spent more time with my wife, my kids, my parents? That you’d pursued your interests in drawing or badminton or whatever it is? Or regret not having been as kind as you could be?

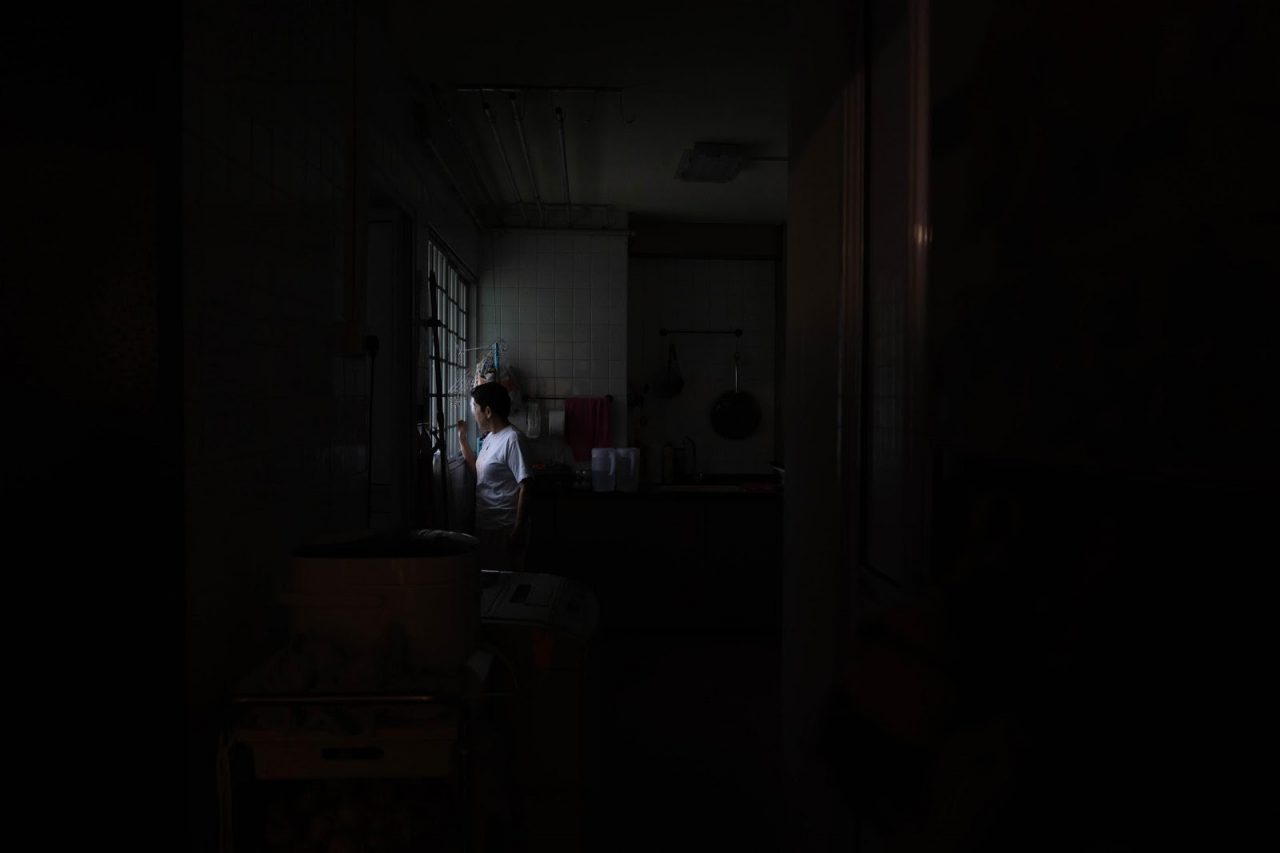

Beatrice Suares, 72, was a Human Resource Coordinator. She retired at 69.

Understandably, it took some time before I got adjusted to retirement life. It was difficult at first, but I am growing to enjoy the process now.

I worked in Human Resources for close to 40 years. Back then, I interacted with a lot of people. It was initially stressful as I was dealing with payroll and that means little room for mistakes. After working for a couple of years, I eventually got used to the scope of work. But like with any job, the pressures still came every once in a while.

When I reached 55, I had to start thinking about retirement. I made the decision to not depend on my children. Children have their own life. What happens if they’re cash strapped and unable to help us at all? That was my main motivation in ensuring that I remain financially independent.

Rather than withdrawing all of my CPF savings when I reached 55, I learned that I could continue to earn attractive interest on my CPF savings. As I was still earning an income back then, I allowed my retirement savings in CPF to grow and I can now enjoy a monthly payout of $740. I have chosen the CPF LIFE Escalating Plan, which means that I am receiving monthly payouts that have started lower but will increase by 2% every year.

This has been beneficial for me—there’s an added sense of assurance that I will be receiving escalating payouts to help me keep up with any increase in prices of things as I get older, and also for as long as I live! If I were to withdraw all my money at once at 55 years old, I would have a lower payout and may have to look for other sources of income to meet my retirement needs.

Truth be told, when I was in my 20s, retirement was something that I barely even thought about. When you’re young, you naturally choose not to bother. Being older now, I’d tell friends who are younger than me to start saving early. The world has changed so much. Before Covid-19 happened, I used to swim weekly. It’s harder to do that now, as there’s a need to secure a time slot to use the pool and I miss taking part in such hobbies more freely. More than anything, the pandemic has opened our eyes to how things are changing rapidly in today’s world. We never know what the future brings, so it’s always good to plan ahead and be prepared.

When we’ve been working for years on end, it can feel as though we’re stuck in an endless loop. As such, letting go of a regular paycheck can be both scary and exhilarating.

If you ask any person in Singapore, they will tell you that it’s impossible to retire. As it happens, escaping the grind is attainable if we consider options that can help to secure our financial future.

Learn more about how you can kickstart your retirement plan and maximise your CPF savings here.

If you haven’t already, follow RICE on Instagram, Spotify, Facebook, and Telegram.

Trying to escape the rat race too? Share your thoughts with us at community@ricemedia.co.