Photos by Shiva Bharathi Gupta for RICE Media.

Paul Foster steps out of his electric car amidst the midday heat on a late Friday afternoon. He is dressed comfortably in a blue T-shirt and surf shorts.

“The weather has been crazy these days,” the 42-year-old mentions, chuckling, as he orders his dog, Bam Bam, to stay in her place.

Paul is a veteran in Singapore’s entertainment industry, successfully building a name for himself as a host, actor, and TV personality.

These days, his schedule is as packed as ever. He modelled for his friend’s clothing line on Monday, attended four meetings and helped his mother settle into her new place on Tuesday; he also had full-day shoots on Wednesday and Thursday. Between those projects, he heads to the gym.

His schedule would have been of no surprise to anyone–except for the fact that he just recovered from a surgery, done a few months ago. He is currently on a self-imposed time off.

A Routine Health Checkup Gone Sour

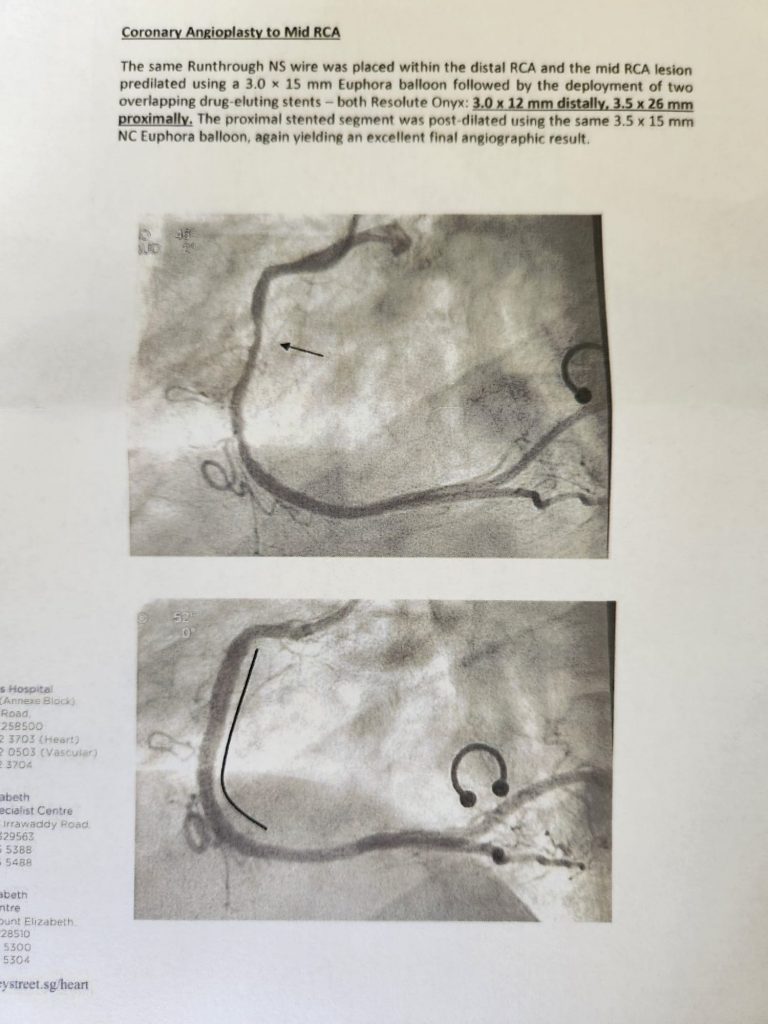

In February 2023, Paul went for an invasive angiogram. Under the hood, four stents and two balloons were surgically inserted to allow blood to flow more freely through his arteries.

No one would have expected Paul Foster, someone who considers himself a gym rat, to suffer from a critical illness at a relatively young age.

“Fitness was always a part of my lifestyle. I played a lot of sports and hit the gym.” Paul also didn’t expect early symptoms of critical illness until a routine health checkup raised worrying signs.

The CT scans, which were supposed to be routine, raised an alarm unexpectedly in April last year. The tests suggested signs of coronary heart disease.

“The lipoprotein levels were dangerously high. I was referred to a cardiologist,” he recounts. “I had major blockages in two arteries and two branches.”

To make matters worse, Paul was in the middle of shooting ‘Camo Kakis’, a physically demanding television show where he tried his hand at different military vocations—undergoing anything physically gruelling, from the fundamentals of basic military training to clandestine search and rescue operations with the air force.

He was medically cleared to continue filming. But his heart worked much harder to pull through the shoot because of his condition. Without him knowing, his heart has probably been working a lot harder to get him through physically demanding situations.

His cardiologist sat in front of Paul, telling him he “saw a 42-year-old man who eats well, exercises, doesn’t smoke, not overweight, and drinks moderately.”

The blood tests and CT scans, on the other hand, “showed the heart of a 60-year-old man who doesn’t eat well or exercise, is obese, and smokes and drinks frequently,” Paul recalls.

“I could have had a heart attack in the next two to five years.”

The Not-So-Hidden Costs of Healthcare

He wasn’t knocking on death’s door, but he wasn’t far away from its neighbourhood.

Paul has remained unshaken, at least he tells me so. “In an ironic way, it’s because fitness has always been a part of my life that led me to be okay with finding out about my condition.” He reckoned he had put in enough hours in the gym and had eaten healthily enough to tide over his condition.

It was a vote of confidence in the work he had put in the years he’s spent as a fitness enthusiast. However, another question was whether his loved ones could bear the news all the same.

Paul felt uneasy anticipating the kind of labour his friends and family would undergo if they felt it was needed–family members dropping what they were doing to attend to him, friends fretting over a hospital visit. Falling ill stresses our loved ones as much as it does us.

Fortunately, Paul remained blissfully unaware of how serious the surgery would be. He expected, at most, one stent to be surgically inserted to remedy his condition. He found out his clogged arteries needed three additional stents and two balloons. It was far too late for Paul to inform his loved ones–not while he was already lying on the operating table.

“My girlfriend scolded me. She asked why I didn’t tell her about something so serious. Like I said, honestly, I didn’t know the surgery would be that serious until I went in there,” he chuckles.

“I didn’t want to say much because it was purely elective and exploratory. It became serious when they found out they had to do something.”

The surgery, which cost around $66,000, would have added to Paul’s stress. However, he had none because the costs of the surgery were already pre-authorised. Thankfully, having AIA hospital insurance helped to cover about $58,000 of the total cost, which he applied for in January 2015 before the surgery.

Along with wise financial planning and MediSave, he only forked out around $4,000 from his pocket to cover the remaining costs—MediSave covered around $4,000. He was insured in 2015 thanks to the knowledge that he had high cholesterol levels—something he inherited and knew since the age of 30.

Four Stents, Two Balloons, One Heart

According to the Ministry of Health, cancer and ischemic heart disease were the two leading principal causes of death in 2021. Critical illnesses can happen to anyone at any time, regardless of lifestyle habits.

For instance, an average of one out of three people in Singapore will be diagnosed with cancer at some point.

We often see cold hard statistics as facts shrouded under a veil of emotional detachment. After all, critical illnesses can happen to anyone. That fact barely motivates anyone to get off their couch to do something about it. It only becomes real when it happens to us.

Under the sheen of a manicured media personality, Paul’s experience perfectly captures the same mistakes any other human being is susceptible to making: an optimism bias, the tendency to overestimate the likelihood of good things happening to us, and underestimating the chances of bad things occurring.

The illusion of invulnerability wears off sooner or later. “A lot of people take their health for granted. When they found out I went for a procedure for my surgery, they asked about how it happened. After all, I was keeping fit and healthy,” they said.

It’s why Paul felt surprised when he discovered that his overworked arteries needed four stents and two balloons instead of one.

“I never thought I needed any but had a feeling that maybe one stent, if anything at all.”

According to an article published by Asia Advisors Network, 80% of critical illness patients and their caregivers regret not buying more insurance coverage. When asked why they carried these regrets, close to half of the respondents with no critical illness assumed that plans like MediSave and MediShield were sufficient.

The Long Road to Recovery

It’s easy to forget that Paul’s surgery was barely three months ago when you’re talking to him. There are no signs of stopping him. Even in the days and weeks following Paul’s surgery, he was still shuffling from place to place, booking jobs, and meeting new clients.

“The surgery for the four stents and two balloons took about an hour and a half. I was fortunate enough to have a great doctor,” Paul recounts, pouring over the details of what others would find a grim tale to tell with glee. “I stayed overnight at the ICU on a Friday. I left on a Saturday. Everything was great. I was tired, but I felt good.”

The end of the surgery marked the start of careful management. Paul is now on blood thinners and bi-weekly injections to reduce his cholesterol levels; each injection costs around $500.

He admits that AIA’s payouts were a blessing. His AIA critical illness coverage will help to cover a year’s worth of medication—a year’s worth of drugs amounts to $18,000.

A freelance media personality’s income waxes and wanes with the number of jobs they take on. Paul, however, could depend on payouts from AIA critical illness coverage to make up for any losses of potential income.

Paul, having known that he had high cholesterol levels since he was 30, purchased his critical illness coverage in 2015. Eight years later, he’s thankful that decision’s paid off.

“I’m always grateful for the work I do. But I am now trying to be more selective with the work I do. I’m trying to be more present,” Paul recalls.

“I haven’t confronted my own mortality yet. If something like a heart attack happened, I would have. Basically, my surgery defused a ticking time bomb.”

A Heart-Stopping Scare

Before the health scare, Paul took whatever jobs came his way when pandemic restrictions were relaxed. He shuffled between shoots, interviews, and hosting gigs. Any vacant slots in his schedule were squeezed out for his gigs.

While his schedule is still packed, he is now more conscious of his body and priorities. He’s become more cautious to sign to a new project. In his words, he “listens to his body before trying to take it on.”

“I’m focusing on hosting events, travel, filming, and things that can be more client controlled—jobs that I don’t have to think about after finishing.”

Of course, a freelance media personality’s livelihood depends on the number of jobs they book. But now, Paul is more willing to compromise and turn jobs down for his health.

“I am more ready to meet the compromise because of the critical illness coverage. I didn’t have to tap into my savings post-surgery for the subsequent medication thanks to the payouts.”

Bam Bam, his husky, bounds towards the sofa. Instinctively, Paul gets up to look for the leash, signalling the end of the interview. “We’ll probably go for a walk later,” he remarks as he fills up a watering can. Paul was medically cleared one month after the procedure. Now, he has his sights set on getting back into training.

“I’m one of the lucky ones. I’m just glad I could share my experience from a positive angle. We take ourselves for granted. Don’t ignore your body. A lot of the time we fall into that trap.”

“We can definitely all do better to take care of ourselves.”